The US wind market recorded notable growth in the first quarter, with 2.1 gigawatts (GW) of new installations. This increase represents a 91% rise compared to the same period last year. All newly installed capacities stemmed from onshore activities, confirming the attractiveness of this segment in the current context.

Regulatory uncertainty weighs on sector dynamics

Despite this strong growth in installations, the sector is facing turbulence. Wind turbine orders for the first half of the year fell by 50% year-over-year, reaching their lowest level since 2020. Published forecasts indicate that total added capacity in 2025 could reach 8.1 GW, including onshore, offshore and repowering projects.

Operators attribute this decline to multiplying regulatory uncertainties, notably the implementation of new tariffs and the prospect of changes to fiscal policy. The recent adoption of the One Big Beautiful Bill Act (OBBBA) has disrupted eligibility criteria for tax credits, while a directive from the Department of the Interior is increasing scrutiny of wind and solar projects.

Shifting outlook for onshore and offshore segments

The onshore market is expected to experience increased volatility until 2029, a period marked by a net reduction of 430 MW in forecasts. This slowdown is mainly due to the growing complexity of permitting procedures, tariff risks and the scheduled end of fiscal incentives. Nevertheless, an intensification of activity is anticipated in 2029 and 2030 as developers look to maximise fiscal advantages before they expire.

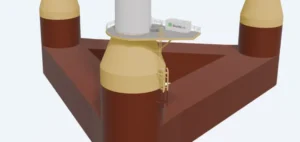

For the offshore segment, the scenario remains more stable in the short term, with the main projects already under construction. Five-year projections indicate an additional 5.9 GW of offshore wind capacity by 2029. However, no new projects are expected to reach a final investment decision during the next presidential term, which could slow the growth of the segment in the following decade.

Recomposition of investment strategies and regional dynamics

The western region is expected to concentrate nearly 9.4 GW of additional installations by 2029, surpassing other national territories. The adoption of the OBBBA is significantly altering project planning, shifting the eligibility criterion for tax credits from the “placed in service” stage to the “start of construction.” This change creates a twelve-month window to launch projects and secure the so-called “safe harbor” provision for four years, pending confirmation of the terms by the Internal Revenue Service (IRS).

Constraints on the supply chain and permitting timelines may continue to weigh on the schedule for early commissioning, prompting many actors to bring forward equipment orders to take advantage of current conditions.

By 2029, the national wind fleet should reach 197 GW, including 44 GW of new capacity split between onshore, offshore, and repowering projects. Sector modelling forecasts an average 25% increase in the Levelized Cost of Energy (LCOE) should tax credits expire, compared with an increase of up to 10% in scenarios linked to tariffs. According to Leila Garcia da Fonseca, director of research, public policy support remains central to maintaining the US wind sector’s pace of installation.