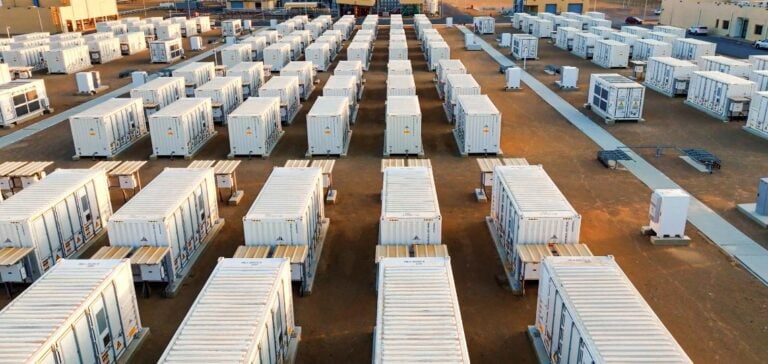

As part of its strategy to diversify its energy mix, Saudi Arabia has announced the launch of a tender for the development of Battery Energy Storage Systems (BESS). These projects, totaling 2,000 MW of capacity, will provide up to 8,000 MWh of stored energy, promoting better management of renewable energy sources, including solar and wind, within the national grid.

The initiative, led by the Saudi Power Procurement Company (SPPC), includes four projects to be developed under the build-own-operate (BOO) model, granting full ownership to the selected companies. These projects are distributed across different regions: the Al-Muwyah and Haden projects, each of 500 MW in the Makkah province; the 500 MW Al-Khushaybi project in Al-Qassim province; and the 500 MW Al-Kahafa project in Hail province.

The BOO Model and Its Implications

This BOO model, favored by Saudi Arabia, allows companies to design, finance, build, own, and operate energy storage facilities, fostering direct involvement and autonomy of private developers in the energy market. Companies selected for this tender will sign a 15-year storage service agreement with SPPC, the kingdom’s principal electricity purchaser. This long-term commitment provides investment security for operators and secures energy supply for the country.

Supporting the Kingdom’s Energy Goals

The deployment of these storage systems is an essential lever in achieving Saudi Arabia’s ambitious energy goals. The kingdom aims to increase the share of renewable energy to about 50% of its electricity mix by 2030, reducing its reliance on fossil fuels. Storage capacities enable the smoothing of production fluctuations inherent to intermittent energy sources, like solar and wind, offering increased grid stability.

Context and Renewable Energy Developments

The announcement of this storage tender comes amid strong momentum in Saudi Arabia’s renewable energy sector. Earlier this year, SPPC launched a renewable energy tender totaling 4.5 GW. Several companies have been shortlisted for the next stage of competition, which includes four solar projects with a total capacity of 3.7 GW. Meanwhile, Riyadh-based developer ACWA Power reached financial close on 5.5 GW of solar projects, confirming the Saudi private sector’s commitment to the energy transition.

These storage systems are crucial for these ongoing solar projects, enabling the conservation of produced energy for periods of high demand and contributing to the overall efficiency of the grid. By incorporating these storage capacities, Saudi Arabia is preparing to manage supply variations and improve the resilience of its energy infrastructure.

Perspectives for the Energy Sector in Saudi Arabia

These strategic initiatives indicate a clear orientation toward a more sustainable energy future for Saudi Arabia, which aims to reduce its dependence on oil and diversify its economy. The construction of these storage facilities, alongside investments in renewable energy, strengthens the kingdom’s position as a major player in the regional and international energy sectors.