The global energy transition is at a pivotal moment. According to the Global Energy Scenarios 2024 report, published by Rystad Energy, it is still possible to limit global warming to 1.6 degrees Celsius above pre-industrial levels. However, this ambitious goal will require an accelerated and comprehensive transformation of the energy sector. The report identifies three essential steps to realize this transition: rapidly increasing renewable energy capacity, electrifying sectors still dependent on fossil fuels, and developing solutions to eliminate residual emissions from hard-to-abate industries.

Strengthening the renewable energy sector

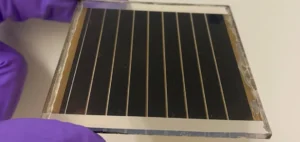

One of the primary levers for reducing CO₂ emissions lies in the electricity sector. In 2023, electricity production accounted for approximately 39% of global emissions, with 15 gigatons of CO₂ emitted. To reverse this trend, it is crucial to strengthen operational capacities in renewable energies, notably solar and wind, while accelerating the closure of coal-fired power plants. The report anticipates a significant increase in installed solar module capacity, which could reach 1.65 terawatts in 2024—a 63% growth in just one year. The continuous cost decline in solar, wind, and battery technologies also fuels this growth, offering an economically viable alternative to fossil fuels.

Electrification of key sectors

The second pillar of this transition rests on the electrification of sectors such as transport, industry, and buildings. These sectors, heavily reliant on fossil fuels, represent a substantial share of global emissions. According to the report’s estimates, maximizing the economically viable electrification potential in these sectors would achieve 43% of the emission reductions needed to realize the 1.6-degree scenario. The growth of electric vehicles (EVs), for example, demonstrates an accelerated adoption of clean technologies. In 2023, EVs represented 23% of new car sales worldwide, compared to only 3% four years earlier. This rapid adoption illustrates the shift in preferences toward more sustainable and less polluting energy solutions.

Managing residual emissions

Certain industries, such as steel, cement, and aviation, remain challenging to decarbonize due to their energy-intensive nature. For these sectors, electrification alone is insufficient. This is where technologies such as carbon capture, utilization, and storage (CCUS) come into play, as well as alternatives like hydrogen-based fuels and biofuels. However, these technologies are still in the early stages of development and require technical, economic, and regulatory advancements to become viable. The report emphasizes that by combining greater energy efficiency with advances in these technologies, the energy sector could significantly reduce residual emissions, making the global energy system both cleaner and more efficient.

Toward an accelerated energy transition

The success of these three fundamental steps could enable the realization of the most ambitious climate scenario, though it will require swift and coordinated mobilization. Agriculture, for example, presents a potential to reduce methane emissions through innovations such as precision fermentation, which cuts methane emissions by 97% compared to traditional animal agriculture. Additionally, practices like agrivoltaics, which combine solar production with agricultural activities, could meet energy demands using only 3.8% of agricultural land, allowing a faster expansion of renewable energies.

In summary, the Global Energy Scenarios 2024 report provides a roadmap for accelerating the global energy transition. By following these three strategic steps, the world can move closer to the goals of the Paris Agreement and build a more resilient and sustainable energy future.