Standard Uranium announces the significant expansion of its Corvo project in the eastern Athabasca Basin, Saskatchewan, Canada.

With the acquisition of three new mining claims, the company increases the size of its project to 12,265 hectares.

This development strengthens its exploration capacity, with an extension of the exploration corridor from 14.5 km to 29.3 km, offering new opportunities for the identification of uranium deposits.

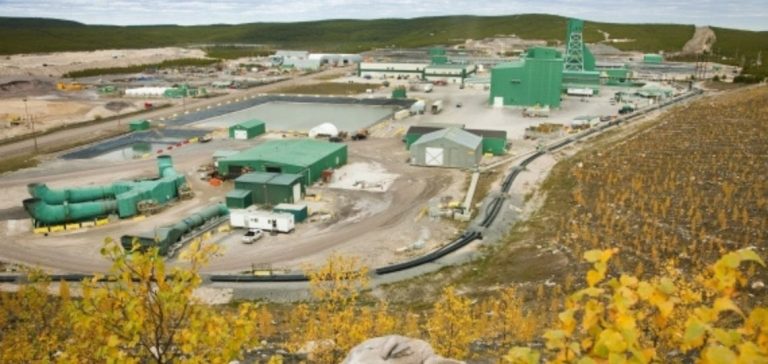

The Corvo project is strategically located near major uranium deposits such as the Gemini Mineralized Zone (GMZ) and Cameco’s McArthur River mine.

The expansion covers areas with geological faults and electromagnetic conductors, which are key indicators of uranium mineralization.

This area, well known for its rich uranium content, is one of the most promising for the development of shallow deposits.

Exploration plan for 2024: a modern geophysical survey

As part of its 2024 objectives, Standard Uranium plans to carry out a high-resolution aerial electromagnetic survey of the entire Corvo project.

This process aims to accurately identify conductive corridors and faults, facilitating the targeting of new drilling zones.

This type of survey is crucial for validating geological anomalies, reducing exploration risks, and ensuring the identification of high-potential drilling targets.

At the same time, a field prospecting campaign will be launched to validate the historical results of uranium discoveries, particularly in the “Manhattan Showing” area.

This area has revealed high-grade uranium samples (up to 59,800 ppm at surface), but has never been drilled in depth.

This phase of prospecting is aimed at uncovering target areas for future drilling, thus contributing to the project’s attractiveness for potential exploration partnerships.

An accessible project for strategic partnerships

The Corvo project is an attractive candidate for investors and partners seeking opportunities in the uranium sector.

The project’s proximity to key infrastructure, such as the Rabbit Lake mill and Highway 905, facilitates its development.

As a project available for joint venture or option, Corvo benefits from favorable logistical access and conditions conducive to rapid resource development.

The project’s expansion is also designed to meet the growing demand for uranium as a key component of global energy production.

As energy markets turn to low-carbon sources, the discovery and exploitation of new uranium deposits is becoming a strategic priority.

Corvo, with its shallow targets and favourable geological characteristics, is well positioned to contribute to this dynamic.

Uranium prospects in the eastern Athabasca Basin

The expansion of the Corvo project reflects Standard Uranium’s strategy to increase its presence in the eastern Athabasca Basin, a region renowned worldwide for its high-quality uranium deposits.

By increasing its land holdings in this area, the company is in a strong position to capitalize on the growing interest in uranium.

The region, already home to several first-rate projects, continues to attract the attention of investors and operators alike.

With this expansion, Standard Uranium is pursuing a long-term strategy aimed at maximizing exploration potential while limiting initial costs through the use of modern geophysical detection techniques.

With recent discoveries in the area, the Corvo project could become a key player in the sector.