EDF has officially applied to the French Nuclear Safety Authority (ASN) to authorize the first divergence of the Flamanville EPR (European Pressurized Reactor), a decisive step for the start-up of this new-generation reactor.

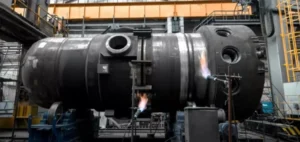

In May 2024, the company completed the loading of 60,000 nuclear fuel rods into the reactor vessel, a process that continued with cold tests until July, followed by hot tests where the reactor pressure was raised to 155 bars and the temperature to 303 degrees.

These tests are the final stage in a project that began seventeen years ago and has been plagued by a series of technical problems, including cracks in the concrete slab and welding defects in the containment vessel.

These technical difficulties not only delayed the reactor’s commissioning by twelve years compared to the original 2012 schedule, but also quadrupled the budget, from 3.3 billion euros to 13.2 billion euros.

In 2020, the French Cour des Comptes estimated that the total cost of the project, including additional financing costs, could reach 19 billion euros.

Technical and financial challenges: Management under pressure

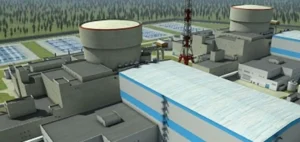

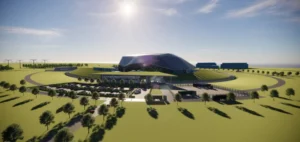

The Flamanville EPR, located in the French department of Manche, is set to be the fourth reactor of its type installed worldwide, and the most powerful in France, with a capacity of 1,600 MW.

This long-term project has raised numerous management and supervision challenges.

EDF claims that no changes to the schedule are currently planned for the connection to the electricity grid, also known as “coupling”, and is aiming to produce the first electrons by September 21, 2024.

When the reactor reaches full capacity, it will be able to supply around three million French households.

EDF hopes to reach full production before the end of the year, although the reactor is already scheduled to operate at 25% of capacity when it is initially commissioned.

The start-up of the Flamanville EPR is of strategic importance as France seeks to revitalize its nuclear industry.

The government has ordered six new EPR2 reactors, with an additional eight as an option, a strong sign of its determination to support this technology despite the delays and extra costs observed.

Symbolism and implications for the nuclear industry

The Flamanville project comes at a key moment in French energy policy.

The last nuclear reactors commissioned in France were Chooz in 2000 and Civaux in 2002.

The start-up of the Flamanville EPR, although initiated well before the government’s recent decision to revive nuclear power, takes on a highly symbolic dimension for the future of the industry.

EDF has the opportunity to demonstrate that the technical difficulties encountered on this project can be overcome, and to set a positive precedent for future EPR2s.

As for the ASN, it plays a key role in ensuring that the reactor complies with all safety standards before giving its go-ahead for commissioning.

This vigilance is all the more crucial given the project’s track record.

For EDF, the stakes are high: restoring confidence in its ability to manage projects of this scale, while respecting safety and cost constraints.

Impact on energy and industrial strategy

The commissioning of the Flamanville EPR will have significant implications for the French nuclear industry and for EDF, which remains wholly state-owned.

The ability to meet the deadlines and costs for this reactor will influence perceptions of the feasibility of future nuclear projects, particularly in a changing European energy market.

The evolution of this project could also serve as a benchmark for other nations considering modernizing or strengthening their nuclear capabilities.

Industry professionals are keeping a close eye on developments surrounding the Flamanville EPR.

Its commissioning could either strengthen the position of EPR technology on the international stage, or, in the event of further delays or difficulties, raise questions about the economic viability of these new-generation reactors.

The next few months will therefore be crucial for EDF and the French nuclear industry.