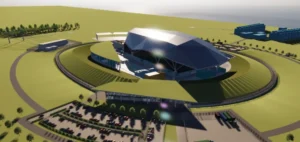

Global energy demand, particularly fuelled by the expansion of data centres and artificial intelligence (AI) applications, has propelled the small modular reactor (SMR) market to unprecedented levels. According to a report released by Wood Mackenzie, the SMR pipeline grew by 42% in Q1 2025, reaching a total of 47 gigawatts (GW). This increase, representing an additional 14 GW compared to the previous quarter, reflects a strong push toward nuclear energy to meet an increasingly pressing energy demand.

Data centres driving SMR demand

The share of data centres in the SMR pipeline has reached 39%, a rapidly growing proportion, although power generation remains the dominant segment with 51% of the total capacity. This shift is explained by the rise of technologies requiring increased computing power, such as AI, which demand reliable, low-carbon energy sources.

The market expansion is accompanied by an estimated investment of approximately $360bn to reach the 47 GW capacity. The United States currently accounts for 53% of the global pipeline, nearly double the second-largest market, Poland. Major players such as Oklo, GE-Hitachi, and X-Energy together account for nearly 31 GW of the pipeline capacity.

Rising costs due to tariffs

However, challenges remain for the sector’s growth. The report highlights the potential impact of trade tariffs, which could increase construction costs for new nuclear reactors by 6% by 2030. In particular, tariffs on steel and aluminium imports to the United States are expected to drive up costs, especially between 2028 and 2035.

The issue of tariffs on enriched uranium is also raised, with potential impacts on the overall cost of electricity produced by these reactors. Wood Mackenzie notes that tariff levels reaching 145% could present one of the main risks to the nuclear sector. This could lead to a rise in global market prices, both for spot and long-term contracts.

Gradual deployment but limited for now

Currently, around 2.5 GW of SMR capacity is under construction or development, with 1.2 GW in Canada. Despite the dynamic pipeline, the majority of announced projects remain industrially uncommitted. The pace of realisation will heavily depend on the regulatory environment, financing conditions, and the evolution of construction costs.

“The renewed interest in SMRs, especially from data centres, positions them as a strategic lever in the future energy mix,” said David Brown, Director of Energy Transition Research at Wood Mackenzie.