Faced with a prolonged drought, Zambia is stepping up its energy restrictions by extending power cuts to 17 hours a day from September.

This decision stems from the dramatic drop in water levels in the hydroelectric dams, which supply most of the country’s electricity.

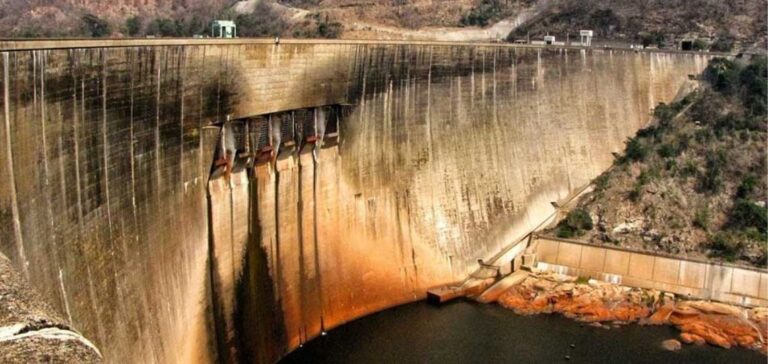

The Kariba dam, in particular, is in critical condition, with only 10% of its capacity available for power generation.

This situation poses difficult choices for the government, which must now juggle managing the crisis with the growing energy needs of the economy.

The immediate impact has been felt in all sectors, with a significant interruption in industrial production and a drop in business productivity.

Energy infrastructures, already under pressure, are struggling to keep up with demand, creating a bottleneck for the economy as a whole.

Impact on the national economy

Prolonged power cuts have had a direct impact on the Zambian economy, which has been weakened.

The International Monetary Fund (IMF) has adjusted its growth forecasts for Zambia, lowering them from 4.7% to 2.3% for 2024.

This revision is largely due to the reduction in electricity production capacity, which is affecting not only the manufacturing industry, but also mining, the country’s key sector.

Companies need to adapt quickly to this new reality.

Costs associated with alternative energy sources, such as diesel generators, are soaring, while less resilient small and medium-sized businesses risk permanent closure.

This situation creates an unstable economic environment, with repercussions for employment and household incomes.

Business adaptation and social risks

The businesses most affected by these prolonged power cuts are those that rely heavily on electricity for their day-to-day operations.

In urban areas like Lusaka, workers such as welders and hairdressers are forced to modify their schedules to align their activities with the rare periods of electrical availability.

This reduces productivity and increases operating costs.

Social risks are also intensifying.

As outages increase, frustration grows among the population.

Companies downsize, leading to layoffs or wage cuts.

Trade unions and employers’ organizations are warning of possible social destabilization if viable solutions are not rapidly implemented to stabilize the energy supply.

Uncertain economic outlook

Zambia’s economic prospects are uncertain in the short term.

Over-reliance on hydroelectric dams, combined with inadequate management of water resources, highlights the structural weaknesses of the energy sector. Recourse to electricity imports, while necessary, is not enough to make up the current deficit, and with the next rainy season only expected in November, the challenges persist.

Economic players are keeping a close eye on the measures the government will take to alleviate this crisis.

Investment in energy infrastructure, as well as the exploration of alternative energy sources, are essential to ensure long-term stabilization.

For the time being, however, the economy remains under pressure, with far-reaching implications for the country’s entire economic and social fabric.