Canadian company Vortex Metals Inc. has announced initial results from its drilling campaign at the Illapel project, located in central Chile. Data from six of the eight drill holes confirms the presence of two mineralised zones: a copper-silver trend near the historic Rio 27 mine, and a network of gold-bearing quartz veins in the southwestern section of the concession.

Encouraging results in the copper-silver zone

Drill hole DVM-08 returned 1.56% copper and 19 g/t silver over 1 metre, within a broader interval of 17.9 metres at 0.20% Cu. This hole, situated near historical workings, also revealed strong hydrothermal alteration and sulphide presence, including chalcocite and bornite.

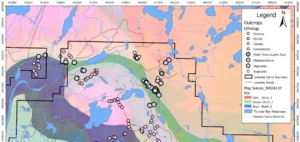

Drill holes DVM-02 and DVM-03 confirmed the continuity of the mineralised structure, including a 2.7-metre section at 0.30% Cu in DVM-02. Resistivity surveys conducted by GEODATOS revealed a broad conductive anomaly from 55 to 122 metres depth around DVM-08, interpreted as possible off-hole mineralisation.

Expansion of IOCG potential on site

Geological features observed in several drill holes, including DVM-08, suggest possible Iron Oxide Copper Gold (IOCG) style mineralisation, notably with the presence of iron oxides and sulphides in volcano-sedimentary rocks. This geological context is comparable to the El Espino deposit, located 13 km away, which hosts 150 Mt at 0.55% Cu and 0.22 g/t Au.

GEODATOS has identified six additional geophysical targets in the area, which may be drilled in subsequent phases. Concurrently, Vortex has initiated mapping and geophysical surveys approximately 4 km northeast of the current zone, aiming to extend exploration along the mineralised corridor.

Gold grades in the southwestern concession area

Three drill holes (DVM-04, DVM-05 and DVM-06) targeted a surface-exposed network of quartz veins containing both copper and gold. Hole DVM-06 returned two gold-bearing intervals: 0.8 metre at 1.99 g/t Au and 1.7 metres at 1.18 g/t Au. These findings confirm an active gold system associated with surface-mapped structures.

The geology of this area shows similarities to the nearby Farellon Sánchez district. Full assay results from DVM-01, remaining intervals of DVM-05, and DVM-07 are still pending. All samples were analysed by ALS Laboratories in Santiago.