The idea of adding value to captured carbon dioxide (CO2), beyond its simple storage, presents itself as a solution for strengthening the economics of carbon capture projects.

By transforming CO2 into value-added industrial products, such as e-fuels or certain construction materials, companies can diversify their revenue streams.

However, at present, less than 5% of carbon capture projects announced worldwide include CO2 recovery strategies.

This limited proportion underlines the economic and technological challenges associated with these approaches.

Energy and industry professionals are evaluating various business models to make carbon capture projects profitable.

Among the options being considered, the sale of carbon credits generated by emissions reductions offers revenue potential on voluntary or regulated markets.

However, these markets are still in their infancy, and their volatility makes long-term planning difficult.

At the same time, projects are exploring the use of captured CO2 to produce e-fuels or chemical intermediates, but the high costs associated with conversion technologies and the supply of green hydrogen limit their competitiveness.

Regulatory and market challenges for CO2 utilization

The current regulatory framework mainly favors geological storage of CO2, which is perceived as a more mature and less costly solution.

For example, the European Union has specific regulations on the use of CO2, but these are limited to e-fuels for aviation, a segment that is still marginal.

The absence of clear incentives and substantial political support for other forms of CO2 use is holding back the emergence of these solutions.

From a technical point of view, the world’s geological storage capacity is estimated at around 15,000 billion tonnes, which reduces the pressure to rapidly develop recovery solutions.

What’s more, the cost of producing synthetic fuels from captured CO2 is still too high to compete with conventional fossil fuel alternatives.

Developing more cost-effective technologies and stable markets for decarbonized products remains a priority to overcome these challenges.

Ways of recovering captured CO2 and their limitations

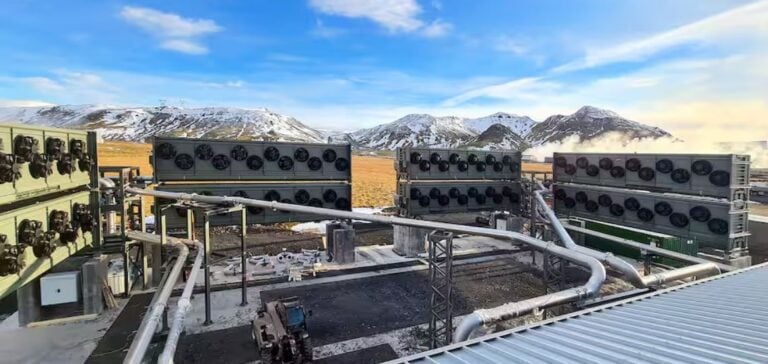

Several CO2 recovery technologies are under development or already available on the market, but their adoption is slow.

One possible approach is mineralization, which involves transforming CO2 into building materials such as limestone.

This method is technically mature and can be competitive in certain contexts, but it does not yet offer sufficient scale of application to have a significant impact on carbon capture targets.

Another option is the use of CO2 in the production of e-fuels for the shipping and aviation sectors.

This approach could compensate for biofuel supply limitations, but it remains hampered by high costs and dependence on green hydrogen and renewable energies.

The prospects of direct competitiveness with traditional fuels remain uncertain before 2040, making these options still unattractive to investors.

Prerequisites for increased adoption and profitability

For the use of captured CO2 to become a viable and widely adopted option, several conditions must be met.

Firstly, a significant reduction in technological costs, particularly with regard to green hydrogen production, is essential.

Secondly, more favorable regulatory frameworks and more robust support policies could encourage innovation and attract investment in this field.

Furthermore, the development of viable markets for CO2-derived products, such as e-fuels or decarbonized building materials, would require increased demand and appropriate financial incentives.

Opportunities also exist in the co-feeding of existing industrial units, such as methanol production or cement manufacturing.

These applications enable partial decarbonization without requiring large capital investments.

However, limitations in terms of scope and production volume make it difficult to achieve full decarbonization with these approaches, and further innovation is needed to maximize their impact.

Current policies must therefore evolve to include specific incentives for CO2 recovery projects, in order to encourage wider adoption of these technologies and boost the competitiveness of the carbon capture sector.