U.S. natural gas inventories are expected to peak at 3,954 billion cubic feet (Bcf) at the end of October 2024, a level not seen since November 2016.

This comes against a backdrop where injections have been less buoyant than expected.

The injection season, which usually runs from April to October, was marked this year by higher-than-average domestic demand for natural gas, due to high summer temperatures and increased power generation.

Data from the U.S. Energy Information Administration (EIA) show that net gas injections into reserves since March 2024 total 1,004 Bcf, 17% below the average for the previous five years (2019-2023).

This slowdown in injections, coupled with strong summer consumption, has gradually narrowed the gap between current storage levels and the historical average, from 39% above average in March to just 6% above average in October.

Regional disparities in stocks

Natural gas inventories in the United States follow a well-defined seasonal pattern, with injections mainly concentrated between April and October, followed by withdrawals during the winter season.

However, the South Central region, home to the country’s most flexible storage facilities, shows a distinct behavior.

The salt caverns in this region allow withdrawals even during the summer, in response to peaks in demand for power generation. The South-Central region, covering key states such as Texas and Louisiana, concentrates almost a third of the country’s total underground storage capacity.

This region also boasts more flexible injection and withdrawal capacity, enabling it to adapt quickly to fluctuations in demand, both for the domestic market and for exports.

Influence of LNG exports

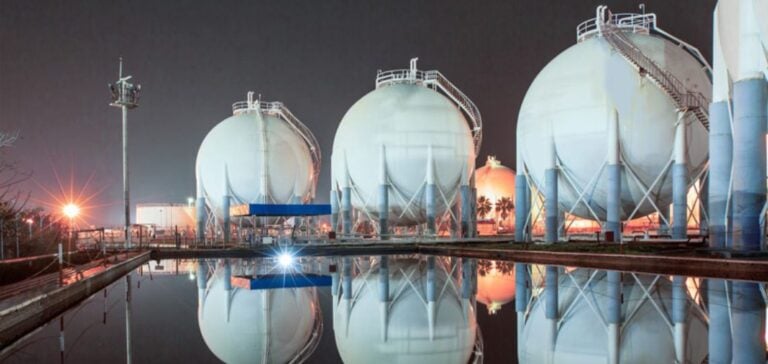

Liquefied natural gas (LNG) export capacity in the South Central region, particularly along the Gulf Coast, plays a crucial role in natural gas storage dynamics in the United States.

Since 2016, this region has become the nerve center for LNG exports, with export capacity now reaching 10.8 Bcf per day.

The flexibility of the salt caverns and the proximity of the export terminals enable the Sud-Centrale region to effectively manage variations in demand and export flows.

During periods of maintenance or operational disruptions at the terminals, excess natural gas is stored, while during periods of high summer demand, the same gas is rapidly withdrawn to supply power plants.

Forecasts for the end of the injection season indicate that natural gas stocks will remain an essential lever for balancing supply and demand, in a context of growing consumption, particularly in energy sectors dependent on natural gas for power generation.