The subsea electrical interconnection project proposed by British firm Xlinks First Ltd., intended to transport renewable electricity from Morocco to the United Kingdom, will not receive support from the British government. The official announcement follows a thorough examination by government experts, highlighting major concerns about cumulative risks and misalignment with national strategic priorities.

Rejection of UK government backing

Michael Shanks, Under-Secretary of State at the UK Department for Energy Security and Net Zero, told Parliament that “the project does not clearly align with the government’s objectives aimed at strengthening domestic energy production capacity”. The British government views this complex initiative, requiring a total investment of £24 billion ($33 billion), as involving significant financial and operational uncertainties.

Xlinks had requested from the government a specific financial support mechanism known as a “contract for difference” (CfD). This mechanism is generally used in the UK to ensure a stable, predefined purchase price for electricity producers, facilitating investment in major energy infrastructure, particularly offshore.

Investor reaction to the decision

Dave Lewis, Chairman of Xlinks and former Chief Executive Officer of Tesco Plc, publicly expressed his disappointment regarding this refusal. “We are extremely surprised and deeply disappointed that the British government has chosen not to seize this opportunity,” he stated, specifying nevertheless that the company is already exploring alternative ways to otherwise enhance the project’s value.

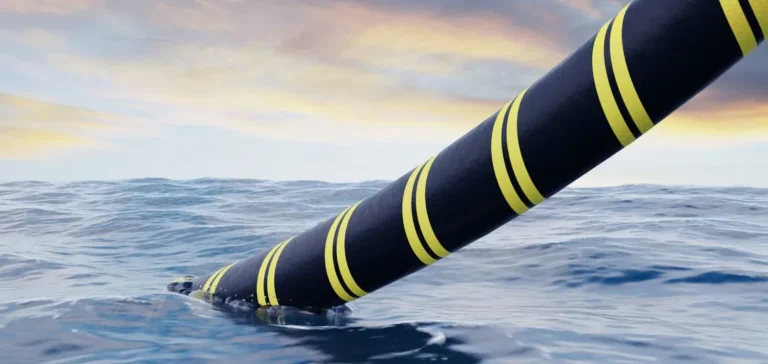

This project, unprecedented in its technological scale, aimed to deliver approximately 11.5 gigawatts of solar and wind capacity installed in Morocco to seven million British households. The electrical interconnection would require installing subsea cables approximately 4,000 kilometres in length, five times longer than the existing link between the UK and Denmark, currently the world’s longest subsea electrical connection.

Project alternatives and outlook

Without British public funding, Xlinks could consider other ways to implement this interconnection. Industrial partners such as GE Vernova Inc., TotalEnergies SE in France, Abu Dhabi National Energy Co. in the United Arab Emirates, or Octopus Energy, had already shown tangible financial commitment to this innovative project.

Depending on future financial and commercial opportunities, Xlinks could potentially redirect its project towards other European countries, notably Germany, which provides alternative prospects for large-scale energy network interconnections.