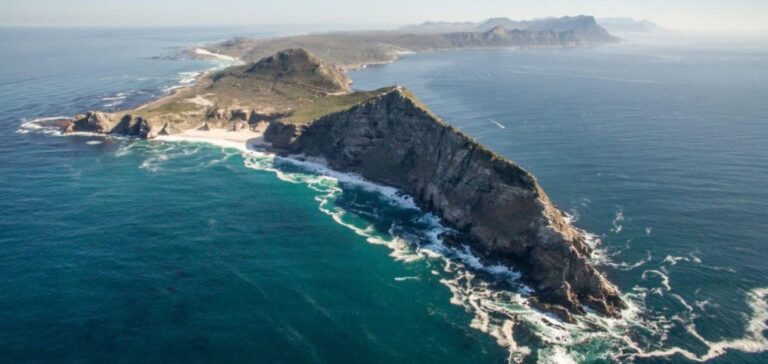

Since the start of the year, although drought-related restrictions at the Panama Canal have improved slightly, the proportion of US LNG exports using the Cape of Good Hope route remained high in March. This follows the attacks on commercial shipping in the Red Sea, forcing shippers to opt for this longer route to Asia, and in particular China, which is now the leading importer of American LNG. No US volumes were delivered to Asia via the Suez or Panama canals in March.

Impact of Climate and Geopolitical Conditions

A historic drought, partly due to the El Niño phenomenon, had already affected passage through the Panama Canal. With the escalation of tensions in the Red Sea in December, an increasing number of volumes began to take the southern route to Africa. In 2024, 46 US LNG cargoes reached Asia via the Cape of Good Hope, compared with 66 for the whole of 2023.

Evolution of Cargoes and Routes

Commercial passage in February saw just five US LNG cargoes transit through Panama to Asia, the lowest total since April 2018. By comparison, only seven American cargoes crossed the Suez Canal this year to reach Asia, compared with 120 in 2023. Despite the risks on the supply side, the Biden administration has announced a pause in LNG export approvals, with no immediate impact on gas balances or US prices.

Freight costs and the LNG market

Freight rates remain relatively stable, despite a drop in the number of available vessels and slowing demand in both basins. Inter-basin arbitrage opportunities remain limited, affecting the direction of cargoes. However, buying interest stimulated by lower spot prices is keeping European and Asian markets well supplied ahead of the injection season.

Despite the bearish environment, activity on the physical Eastern market is brisk, without putting pressure on freight costs. LNG prices in Europe and Asia indicate comfortable inventories to meet any increase in demand. Recent adjustments to routes and freight costs testify to the market’s ability to adapt to changing dynamics.