Subsurface hydrogen stimulation approaches seek to activate mineral reactions that produce hydrogen directly underground rather than relying on random natural accumulations. The most advanced methods replicate known mechanisms, notably iron oxidation and the serpentinization of ultramafic rocks. Project developers target a potential cost below one dollar per kilogram with theoretically low carbon intensity, subject to the energy balance of operations. Key bottlenecks concern yield reproducibility, the durability of flow rates, and the ability to closely monitor reactive deep environments.

Technology landscape: principles, requirements, and TRL

Electrical Reservoir Stimulation (ERS) applies electrical currents to heat and fracture iron-rich lithologies, increase permeability, and accelerate geochemical reactions that release hydrogen; its maturity is at TRL 5–6. Advanced Weathering Enhancement (AWE) injects water to intensify oxidation of ferrous minerals and serpentinization; observed maturity is TRL 4–5. Purely mechanical fracture-stimulation approaches aim to expose fresh mineral surfaces but remain less mature (TRL 2–4) and require strict seismic and environmental oversight. Complementary pathways exist, such as chemical stimulation by acids (TRL 2–3), biological stimulation of microbial communities (around TRL 2), and closed-loop Enhanced Geothermal Systems (EGS) that may bring dual heat-hydrogen value (TRL 3–4).

Two companies are positioning demonstrators on the leading techniques: ERS projects are conducted on ophiolites and other iron-rich rocks, while AWE pilots target peridotites and dunites with high olivine content. In EGS, operators explore using thermal gradients to boost dissolution–precipitation kinetics associated with hydrogen generation. Each pathway demands precise geological matching: electrical conductivity and mineralogy for ERS, availability of reactive ultramafics and hydraulic management for AWE, and adequate temperatures for EGS.

Project economics: activation energy, flow rates, and OPEX

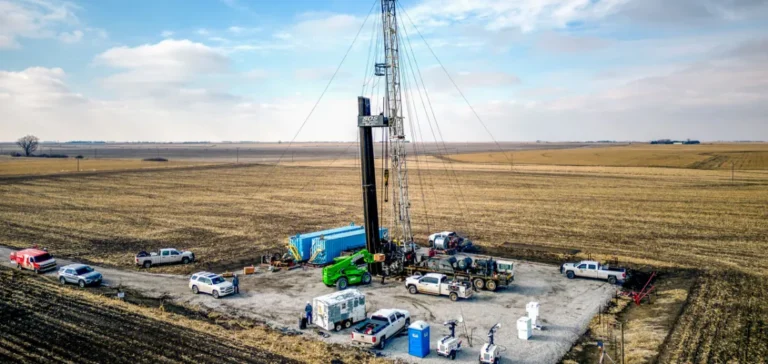

Actual cost per kilogram depends on activation energies (electrical, hydraulic, or thermal), initialized flow rates, and declines. Operators must account for the full cycle: studies, drilling, stimulation, separation–purification, compression, transport, and end of life. Effective carbon intensity derives from the energy mix powering stimulation and any losses. Drilling budgets are the largest CAPEX component at greater depths, while OPEX will vary with restimulation frequency, corrosion management, and prevention of hydrogen embrittlement.

Financial models remain sensitive to decline-curve assumptions, mineral passivation, and progressive fracture closure. A drop in permeability can raise marginal cost if repeated interventions are needed. Conversely, well-oriented multiwell architectures and controlled fracture networks can mutualize treatment facilities and stabilize unit costs. Access to nearby end uses reduces midstream spending and improves bankability.

Geology and site selection: from screening to playbooks

Mineralogical variability within peridotites and basalts directly affects iron-oxidation kinetics and hydrogen generation. The industry seeks standardized geological playbooks: optimal compositions, temperature–pressure windows, fluid chemistry, tectonic constraints, and clogging risks. Shallow or outcropping ultramafic formations offer lower entry costs, but their lateral extent and homogeneity determine installable capacity. Ophiolitic contexts are priority targets, with access and land-use constraints in some cases.

With accumulation mechanisms still poorly understood, the dominant strategy is to produce as close as possible to the reactive rock, without relying on large structural traps. This logic favors modular local developments with progressive pad networks. Early integration of sour-gas treatment or hydrocarbon traces avoids specification bottlenecks.

Environmental risk and monitoring: frameworks and technologies

Stimulation operations alter hydrogeological and mechanical regimes; authorities require surveillance plans covering seismology, water geochemistry, downhole pressures, and micro-deformation. Sensors must withstand corrosive environments and deliver continuous high-resolution data. Control of flow paths, prevention of unintended migration, and pressure-management practices condition authorizations.

Operators adopt predict-measure-adapt approaches: coupled thermo-hydro-mechanical-chemical modeling, baselines prior to stimulation, then short-iteration adjustments. Transparent datasets facilitate acceptance and speed permit processing. Standardized test protocols allow performance comparisons across basins and feed parameter banks for sizing.

Value chain and certification: purity, logistics, and labels

Hydrogen stream composition varies by lithology; separation, desulfurization, and drying units may be required at the wellhead. With dispersed sites, logistics combine small collectors, short-haul trucking, or local injection into industrial uses. Carbon-footprint certification requires verifiable energy balances and traceable emission factors.

Public frameworks structure R&D and deployment: the U.S. Department of Energy (DOE) supports dedicated programs via the Advanced Research Projects Agency–Energy (ARPA-E). In Europe, national geological organizations test EGS configurations and monitoring protocols. These initiatives converge toward common references for safety, performance measurement, and eligibility for support.