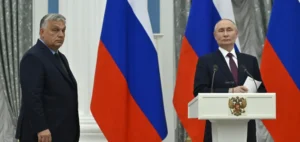

Russian President Vladimir Putin has announced that Moscow is considering restricting its exports of several critical raw materials, such as uranium, titanium and nickel, in response to economic sanctions imposed by the West.

This potential decision could disrupt global markets and have significant repercussions for several strategic industries, including nuclear power, aeronautics and battery production.

Russia’s approach appears to be aimed at protecting its economic interests while strengthening its position in geopolitical negotiations.

Impact on the nickel market

The announcement of possible restrictions immediately triggered reactions on the nickel market.

The price of nickel on the London Metal Exchange (LME) climbed 2.6% to $16,145 per metric ton, underlining the market’s sensitivity to Russian supply.

Russia, via Nornickel, is the world’s largest nickel refiner and a key supplier to China and Europe.

Over 20% of the nickel stored in LME-registered warehouses is of Russian origin.

This metal is essential in the manufacture of batteries, turbine alloys and many industrial components.

Any restrictions on the export of this metal could exacerbate price volatility and affect supply chains.

Uranium supply challenges

Russia holds around 44% of the world’s uranium enrichment capacity, making it indispensable for global supplies, particularly for nuclear power plants in the USA and Europe.

Although U.S. President Joe Biden signed a ban on imports of Russian enriched uranium in 2023, exemptions still allow this uranium to be imported in the event of shortages until 2027.

Short-term alternatives are limited, and costs could rise if utilities turn to other sources of supply.

Russian restrictions could force the USA and Europe to rethink their medium- and long-term supply strategies.

Tensions surrounding titanium in aeronautics

Russia is the world’s third-largest producer of sponge titanium, a material used in the aerospace, marine and automotive industries.

While Boeing stopped buying Russian titanium shortly after the start of the conflict in Ukraine, Airbus continues to import the metal under exemption from Canadian sanctions.

Russian restrictions on titanium exports could create new tensions in aerospace supply chains, prompting manufacturers to seek alternative sources.

This would require significant investment and long-term planning, potentially increasing production costs and creating further uncertainty for the sector.

Economic and industrial risks

The effects of potential Russian export restrictions go beyond the immediate impact on metal prices.

Disruptions in the supply of critical metals such as nickel, uranium and titanium could lead to delays in industrial projects and reduced competitiveness for companies, particularly in Europe and Asia.

Markets must anticipate significant adjustments in their supply strategies, given their dependence on Russian metals.

Western countries may have to accelerate the development of local production capacities or diversify their sources of supply, although these options require time and investment.

Russian strategic outlook

Vladimir Putin stressed that any restrictions on exports would have to be carefully calibrated to avoid harming the Russian economy.

As a leader in reserves of strategic raw materials such as natural gas, gold and diamonds, Russia could use restrictions on metals trade as a geopolitical lever without compromising its own economic interests.

This underlines the importance of raw materials in today’s international relations, where access to natural resources is becoming a key element of economic and political strategy.

Global metals markets could undergo a recalibration, influenced by these potential restrictions.

Companies and governments alike will need to adapt their strategies to cope with the coming changes in the supply and demand for essential raw materials.