Oil prices rose Tuesday as a major export terminal in Turkey was shut down following earthquakes in Turkey and Syria. Analysts also point to the recovery in Chinese demand as an additional factor in the price increase.

Evolution of oil prices

A barrel of North Sea Brent crude for April delivery rose 2.30 percent to $82.85, while its U.S. counterpart, a barrel of West Texas Intermediate (WTI) for March delivery, gained 2.46 percent to $75.93.

Closure of the oil terminal

The Ceyhan oil terminal in Turkey has been closed due to earthquake damage and is expected to remain closed for about a week for evaluation. This major export terminal used to handle one million barrels of crude per day, so its closure has exacerbated supply pressures and contributed to the rise in oil prices.

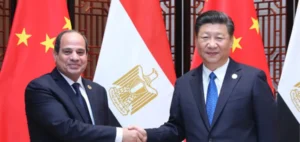

Factors supporting demand

Oil prices were also supported by the reopening of the Chinese economy, which is expected to lead to a significant increase in demand for crude oil this year. In addition, Saudi Aramco, the Saudi oil group, decided to raise selling prices for its customers in Asia, Europe and the United States for March, indicating increased confidence in crude demand.