On March 18, price differentials between LNG and TTF reached notable lows. This price convergence is particularly marked in North-Western Europe and the Mediterranean, with discounts close to their lowest levels since early October for North-Western Europe, and since December for the Eastern Mediterranean. Plattsa subsidiary of S&P Global Commodity Insights, valued the Northwest Europe LNG marker for May at a discount of 23.5 cents/MMBtu to the TTF hub future price for the same month on March 18, while prices in the Eastern and Western Mediterranean were at discounts of 3.5 cents/MMBtu and 28.

Stable in the face of expected price rises

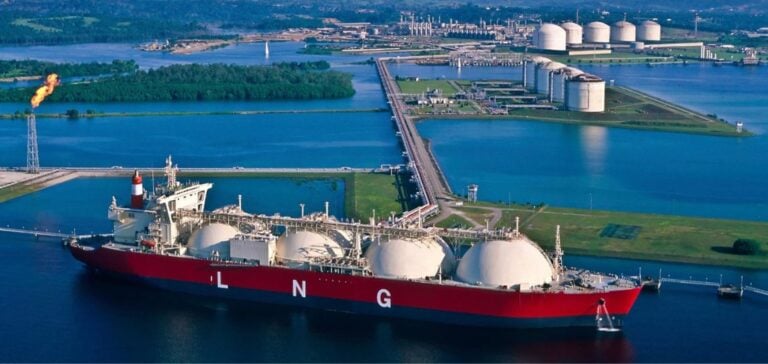

Despite a general upward trend in European gas prices, LNG prices are showing remarkable resilience. Traders are reporting less volatile TTF spreads than expected, thanks to stable supply and demand in the LNG market, despite forecasts of wider spreads.

Effect of injection season on prices

The approach of the injection season, which traditionally boosts gas prices, should logically increase price differentials between LNG and TTF. Traders are anticipating this trend, suggesting an opportune moment to secure supplies before a possible drop in LNG competitiveness.

Regional disparities and logistical challenges

In the Mediterranean, buyers face different realities, influenced by logistical challenges such as shipping constraints in the Red Sea, prompting some to increase their offers to attract more volume. Meanwhile, the western Mediterranean region benefits from more attractive prices, thanks to larger discounts on imports to north-western Europe.

Comments on LNG imports

Until mid-March, LNG import volumes in the Western and Eastern Mediterranean were around half those of February, indicating a potential slowdown in demand. This drop in activity suggests that the market is adapting to recent price convergence, and could presage a downward trend for April.

The narrowing of price differentials between LNG and TTF in Europe testifies to an evolving natural gas market, characterized by increased competitiveness and rapid adaptation of players to a fluctuating price environment. These adjustments reflect the complexity of the European energy market, with its logistical challenges and seasonal variations influencing supply and pricing strategies.