Norway officially inaugurates Northern Lights, the world’s first commercial subsea carbon dioxide (CO2) storage project.

The initiative comes at a time when reducing CO2 emissions remains a priority for many European industries.

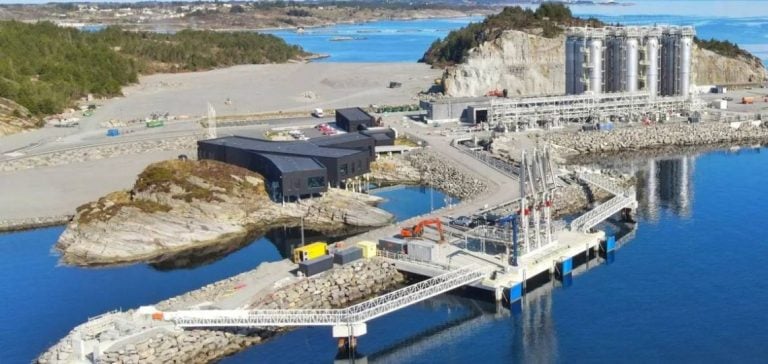

The project involves capturing CO2 directly from industrial sites, liquefying it and then transporting it by ship to an onshore terminal in Øygarden, Norway.

From there, the CO2 is transported 110 kilometers offshore to a saline aquifer 2,600 meters below the ocean floor. This process enables companies to meet their emission reduction commitments by storing CO2 safely and permanently.

With an initial capacity of 1.5 million tonnes per year, the project could reach 5 million tonnes if industrial demand follows.

A costly but necessary solution

Carbon capture and storage (CCS) technology is still in its infancy, and although it is considered essential to achieving global climate goals, its deployment remains hampered by high costs.

Currently, global CO2 storage capacity stands at just 50.5 million tonnes per year, or 0.1% of annual global emissions, according to data from the International Energy Agency (IEA).

To meet decarbonization targets, it would be necessary to prevent the emission of at least 1 billion tonnes of CO2 per year by 2030.

The Northern Lights project benefits from financial support from the Norwegian state, which covered 80% of the costs of the first phase, although the precise amount remains confidential.

This public support has made it possible to overcome some of the economic obstacles associated with this costly technology.

The market for CO2 emission allowances in Europe, which is still relatively affordable for manufacturers, does not provide sufficient incentive for them to massively adopt solutions such as CCS, hence the importance of state support.

First contracts signed despite economic challenges

Northern Lights has already signed several cross-border contracts, notably with companies such as Yara, a player in the fertilizer sector, and Ørsted, a Danish energy group.

These agreements provide for the storage of CO2 captured from plants in the Netherlands and Denmark, demonstrating the growing interest of manufacturers in this emissions management solution.

However, the development of additional contracts remains a challenge.

For the time being, the low cost of European emission allowances makes it more profitable to purchase them than to adopt long-term storage solutions.

CCS therefore appears to be a competing option to the current strategy of manufacturers, who prefer short-term solutions to manage their emissions.

A fast-growing technological model

With its gas pipeline infrastructure and depleted hydrocarbon deposits, the North Sea is a strategic region for subsea CO2 storage.

In addition to Northern Lights, several other projects are under development in Europe.

These include the Greensand project in Denmark, which is scheduled to begin operations in 2026.

These initiatives are part of a dynamic in which manufacturers and governments are exploring solutions to decarbonize the highest-emission sectors, such as steel, cement and chemical plants.

Although complex to deploy, CCS offers interesting prospects for these sectors, which are difficult to decarbonize, and could ultimately become a key solution in the energy transition.

Prospects and challenges for Northern Lights

The large-scale deployment of the Northern Lights project will largely depend on the ability of European manufacturers to adopt this technology as a viable solution for their decarbonization needs.

If the costs of CO2 capture and storage fall, and if emission quotas become more restrictive, CCS could become an essential lever in the management of carbon emissions.

With this project, Norway is positioning itself as a major player in the management of CO2 emissions in Europe, while offering an innovative solution to the most polluting industries.

However, the challenge now lies in convincing a greater number of industrial companies to adopt this technology.