In October, Lukoil resumed crude oil exports via the Druzhba pipeline, which serves Hungary and Slovakia.

This follows the conclusion of agreements between MOL, Hungary’s main refiner, and Belarusian and Ukrainian transit operators.

Under these new arrangements, MOL takes over deliveries from the Belarusian-Ukrainian border, thereby assuming responsibility for transport costs.

This change comes against a backdrop of sanctions imposed by Kyiv, which had previously blocked the transport of Russian crude.

New Transit Agreement and Financial Implications

The agreement changes the previous delivery arrangements, which were based on a “free in pipeline” basis at Feneshlitke in Hungary, creating logistical complications and additional costs for Russia.

MOL now takes possession of the oil at the Belarusian-Ukrainian border, simplifying procedures and reducing costs.

This development may reflect the adaptation of European players to an increasingly complex sanctions environment.

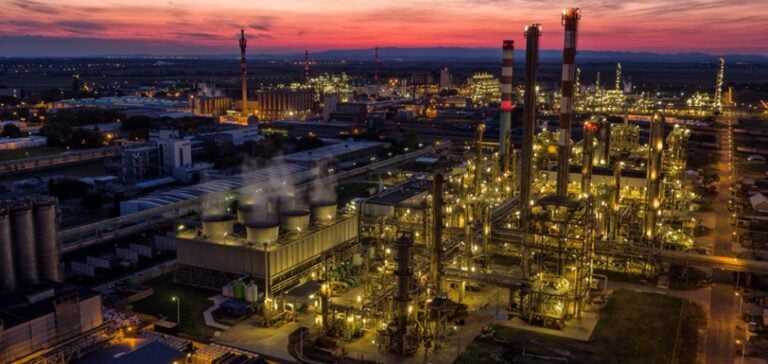

The Druzhba pipeline remains a key infrastructure for oil transport in Central Europe, despite persistent tensions between Russia and transit countries.

Forecast volumes for September are 510,000 tonnes for Slovakia and 360,000 tonnes for Hungary.

However, maintenance work scheduled at the MOL refinery in Slovakia from September 23 will temporarily limit crude oil absorption.

This maintenance schedule must be taken into account in supply management and strategic planning.

Geopolitical context and energy dependence

The resumption of oil deliveries via Druzhba takes place in a tense geopolitical climate, where economic sanctions and transit restrictions are complicating relations between Russia, the European Union and transit countries.

MOL’s decision to assume the transportation costs could be seen as a strategy to stabilize supplies while minimizing the financial and diplomatic risks associated with the current situation.

However, the use of the Druzhba pipeline, which crosses politically sensitive areas, remains a gamble for market players.

Any new sanctions or restrictions could affect these energy flows.

Players in the sector are keeping a close eye on developments to adjust their supply strategies.

Impact on the energy market

This agreement shows how companies in the energy sector are adapting their strategies to changing market realities and the constraints imposed by international regulations.

For MOL, it represents a means of guaranteeing continuity of operations, despite an increasingly complex sanctions environment.

The resumption of exports via Druzhba could serve as a model for other companies in the region.

Nevertheless, uncertainty remains a key factor, and any change in regulations or geopolitical tensions could quickly change the game.

Energy professionals need to keep a close eye on these developments, as they will inevitably affect costs and supply flows.