The United Kingdom is adjusting its energy policy to accelerate nuclear power plant construction and promote the development of small modular reactors (SMRs). Until now, new projects were limited to eight preselected sites. Going forward, facilities may be built across England and Wales, subject to specific criteria.

Relaxed Conditions to Revive Nuclear Power

This announcement aligns with Prime Minister Keir Starmer’s goal of strengthening the UK’s energy security. He argues that the country is too reliant on natural gas, whose supply remains vulnerable to geopolitical tensions. To fast-track nuclear deployment, the government plans to reform land use regulations, which are often seen as a barrier to new infrastructure development.

However, authorities emphasize that strict criteria will still apply when selecting locations. Projects will need to adhere to restrictions, particularly near densely populated areas and military sites.

Small Modular Reactors in Focus

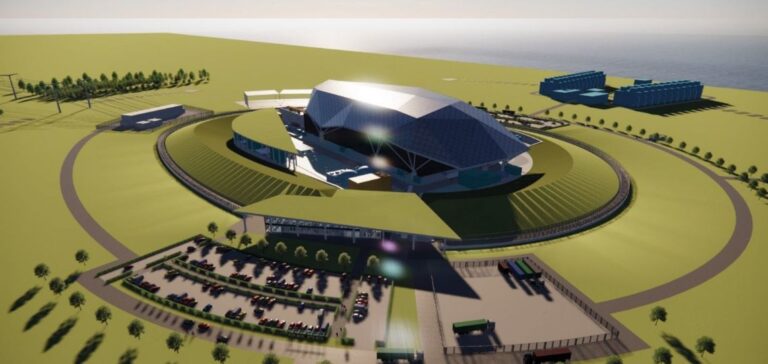

The inclusion of SMRs in legislation aims to encourage this technology, which is seen as a more accessible alternative to large conventional reactors. These smaller units could be easier to finance and construct, but their deployment remains distant. To date, no operational prototype exists, and challenges related to costs and regulations persist.

Four companies are still in the running for SMR development in the UK: Rolls-Royce, GE-Hitachi, Holtec, and Westinghouse. EDF, initially interested, withdrew its bid in the summer of 2024. Meanwhile, the French company continues to drive large-scale nuclear projects, including Hinkley Point C and Sizewell C.

A Nuclear Sector Under Pressure

Despite this political push, the UK’s nuclear sector faces multiple constraints. The existing fleet is aging, and the construction of new reactors frequently encounters cost overruns and delays. The government is banking on diversifying actors and technological models to revitalize the industry, but the success of this strategy remains uncertain.

Greenpeace, a critic of the sector, highlights that SMRs remain an unproven technology and that nuclear projects have a history of exceeding budgets. However, for London, the urgency of energy security necessitates swift decisions, even if it means lifting some regulatory barriers.