Canada-based IsoEnergy Ltd has announced the acquisition of Australian company Toro Energy Ltd for AUD75mn (CAD68.1mn, $49mn). The deal aims to create a company with a diversified portfolio of uranium assets across North America and Australia. The transaction remains subject to regulatory conditions and shareholder approval and is expected to close in the first half of 2026.

Strategic asset consolidation across three continents

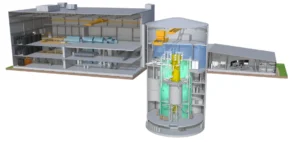

Toro is the 100% owner of the Wiluna project in Western Australia, considered one of the country’s main undeveloped uranium assets. IsoEnergy holds several past-producing sites in the United States and the Hurricane deposit in Canada’s Athabasca Basin. The merger consolidates significant resources in jurisdictions known for regulatory stability.

Shares of the combined entity will continue trading on the Toronto and New York stock exchanges, while Toro will be removed from the official listing of the Australian Securities Exchange. The new company aims to move rapidly towards production, supported by previously permitted or historically validated projects.

Responding to growing global nuclear demand

IsoEnergy Chief Executive Officer Philip Williams stated that the acquisition aligns with the company’s strategy to build a global, development-ready uranium platform. He noted that “the Wiluna Uranium Project strengthens our portfolio with a large, previously permitted asset in a top-tier jurisdiction,” adding that the deal offers “significant scale and sustainable growth opportunities”.

Last year, IsoEnergy had announced plans to acquire Anfield Energy, owner of the permitted Shootaring Canyon uranium mill in Utah. That transaction was terminated in January.

Expanded resource base and shareholder support

Post-merger, the new entity will hold 55.2 million pounds of uranium oxide (U3O8) compliant with NI 43-101 standards in the measured and indicated categories, plus 4.9 million pounds in the inferred category. It also includes 154.3 million pounds of historical measured and indicated resources and 88.2 million pounds inferred.

Toro Energy Executive Chairman Richard Homsany stated that the transaction offers Toro shareholders the opportunity to become part of a larger uranium company with exposure to a diverse portfolio and improved access to funding, particularly for the Wiluna project.

Toro’s 12.7% shareholder Mega Uranium Ltd and its associate Mega Redport Pty Ltd have indicated they intend to vote in favour of the scheme, subject to no superior proposal and provided it remains in the best interests of Toro shareholders.