Iraq, OPEC’s second largest oil producer, has regularly exceeded its OPEC+ quota, causing irritation among other alliance members. In a statement, the Iraqi Oil Ministry affirmed its full commitment to the agreement and voluntary adjustments, promising to compensate for any overproduction since the start of 2024.

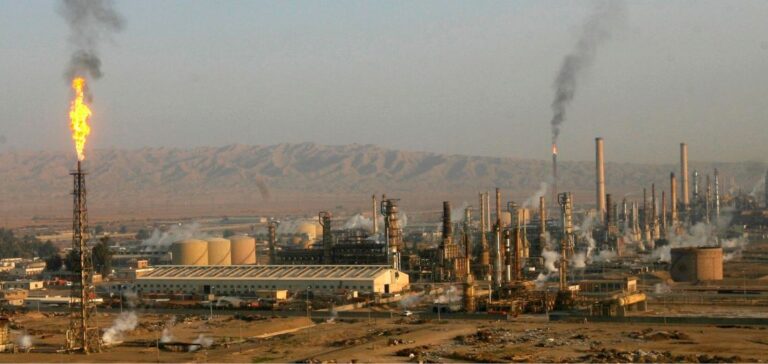

In June, Iraq cut production by 60,000 b/d to 4.22 million b/d, according to the latest OPEC+ survey by S&P Global Commodity Insights. However, despite a reduction in crude oil exports to 3.299 million b/d, total production, including refining, direct combustion for power generation, inventory movements and production in the semi-autonomous Kurdistan region, exceeded quota.

Kurdish production challenges

The Iraqi federal government and the Kurdistan Regional Government (KRG) are at odds over sovereignty over Kurdish oil production, which has led to the closure of the export pipeline to the Turkish port of Ceyhan since March 2023. Prior to this closure, Kurdish production was around 400,000 b/d. Around 50,000 b/d of federal Kirkuk grade production was also prevented from being exported due to the pipeline closure.

Compensation and compliance perspectives

Iraq, Kazakhstan and Russia are the three OPEC+ members required to submit compensation plans for exceeding their quotas throughout 2024. The Kazakh Energy Ministry announced on July 8 that it would submit an updated plan following the publication of June production data in the OPEC monthly report on July 10. Russia has not yet commented on its compensation plans.

The OPEC+ Joint Ministerial Monitoring Committee, co-chaired by Saudi Arabia and Russia, is due to meet online on August 1 to assess members’ quota compliance, and may also recommend changes to OPEC+ production policy. The full OPEC+ alliance will meet on December 1.

Iraq’s oil production management and its relationship with the KRG will continue to be critical factors in OPEC+ quota compliance and global oil market stability. Compensation commitments and future production adjustments will play a crucial role in balancing oil supply and demand, thus impacting world oil prices.