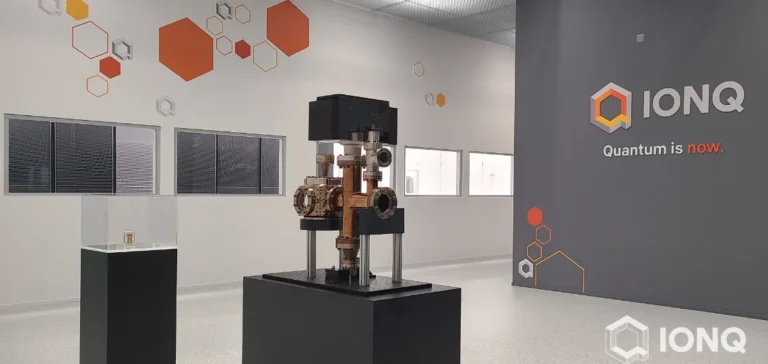

IonQ has entered into a strategic agreement with the University of Chicago to establish the IonQ Center for Engineering and Science on the university campus. This initiative includes the installation of a next-generation quantum computer and a dedicated quantum network for entanglement distribution. It marks the first deployment of such a production-grade infrastructure on a university campus, as classified by IonQ.

A structuring partnership for applied research

The collaboration aims to develop practical applications for quantum technology, involving university researchers in projects aligned with the company’s industrial priorities. The partnership also includes long-term support for academic research, providing direct access to IonQ’s hardware and software tools. The objective is to generate intellectual property that IonQ will leverage for product development and commercial offerings.

The project includes the construction of a dedicated building on campus, partially funded by IonQ, which will host the university’s Pritzker School of Molecular Engineering. The centre will also house scientific and technological departments strategic to quantum research. Furthermore, IonQ will become a core partner of the Chicago Quantum Exchange (CQE), a multi-institutional research consortium.

Towards deeper integration into the US tech ecosystem

This integration into the CQE will allow IonQ to collaborate with partners such as Argonne and Fermilab national laboratories, the University of Illinois, Northwestern, and Purdue. Research areas covered by the partnership include quantum computing, networking, sensing, and cybersecurity, as well as their applications in chemistry, materials, optimisation, and communication protocols.

IonQ already has several university alliances, notably with the University of Maryland, where it operates a quantum research centre, and with Duke University for multi-qubit gate development and quantum algorithms. It also collaborates with the University of Washington on simulations of matter-antimatter asymmetry. These academic initiatives form a strategic network for the commercial development of its technologies.

The company seeks to consolidate its technological and industrial edge by leveraging academic expertise while positioning its products at the core of future US quantum infrastructure.