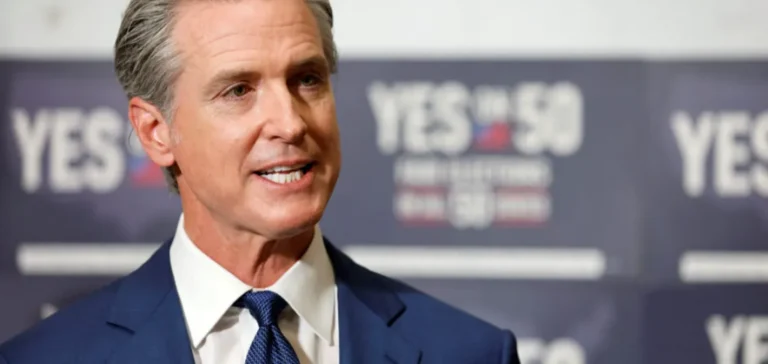

California Governor Gavin Newsom used his appearance at the United Nations Climate Change Conference (COP30) in Belém, Brazil, to declare that his state remains a reliable partner for public and private stakeholders, despite the federal government’s withdrawal from multilateral discussions.

Speaking at an investor forum in São Paulo, Newsom explained that his presence was motivated by what he described as a “leadership vacuum” in Washington, stating that the lack of national engagement compels states like California to strengthen their own international influence channels. He reminded the audience that California’s economy ranks fourth globally, providing significant leverage in shaping energy policy.

California’s economic weight in contrast to federal isolation

Newsom’s trip is part of a broader subnational strategy, including meetings with several governors and international delegations. He held talks with the governor of Brazil’s Pará state, where the summit is hosted. The goal is to reinforce bilateral cooperation on technology and energy, independently from US federal frameworks.

The governor emphasised that California employs seven times more workers in renewable technologies than in fossil fuels. He also highlighted the state’s role in the development of electric vehicle manufacturer Tesla, noting that the company was founded in California, which continues to lead in green supply chain industries.

Competition with China and criticism of federal direction

During his remarks, Gavin Newsom also warned investors of the United States’ declining competitiveness in the face of China’s dominance. He cited China’s control over electric vehicle supply chains, batteries and industrial software as evidence of a strategic gap. According to him, manufacturers such as General Motors are slowing their investment in electric vehicles, weakening their market position.

Newsom criticised former President Donald Trump’s energy policies, asserting that they are turning the US into a “petro state” aligned with a state-led capitalism model similar to China’s. He denounced America’s protectionist tariff approach as counterproductive for industrial investment and collaboration.

A potential national bid?

The South American tour comes as Newsom is increasingly seen as a potential candidate for the 2028 US presidential election. His communication style is shifting, adopting some of the direct and provocative language popularised by Donald Trump, while aiming to project himself as a strategic opponent on energy and economic matters.

While the federal administration chose not to participate in COP30, several diplomats expressed concern that the US could attempt to slow the negotiations from a distance. Newsom, in contrast, is seeking to present an alternative vision, relying on state-level autonomy in a context of growing fragmentation in US energy governance.