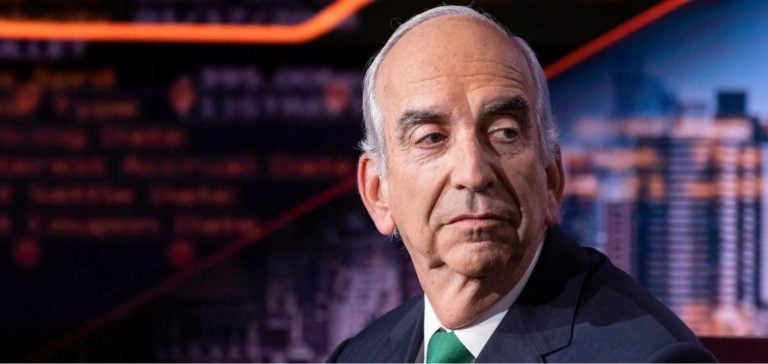

Chevron’s $53 billion acquisition of Hess has prompted the Federal Trade Commission (FTC) to intervene once again, prohibiting John Hess, current CEO of Hess Corporation, from holding a seat on Chevron’s board of directors.

This decision is part of a series of restrictions imposed by the US antitrust agency to prevent any form of excessive concentration in the energy sector.

The FTC seeks to limit the influence of executives during mergers between large companies, particularly in a sector where collusion between players could affect competition and market prices.

The FTC already applied a similar restriction to the merger between Exxon Mobil and Pioneer Natural Resources, preventing Pioneer CEO Scott Sheffield from joining Exxon’s board.

The case of Chevron and Hess shows that this approach is becoming standard practice in the control of mega-mergers in the oil industry.

The issues surrounding Hess’s Guyanese assets

A crucial aspect of this acquisition is Chevron’s takeover of Hess’ Guyanese assets.

Hess owns 30% of the Stabroek offshore block, which has emerged as one of the world’s most promising oil fields since 2015.

The block is operated by Exxon Mobil, which owns 45%, while China’s CNOOC controls the remaining 25%.

Chevron’s rise to power in Guyana, via this acquisition, is causing concern among its competitors.

Exxon and CNOOC have filed an arbitration suit to block the deal, arguing that it could distort competition in this strategic region.

They argue that Chevron could use these new resources to strengthen its position in the sector, making market access more difficult for other companies involved in the Stabroek block.

This arbitration remains one of the last obstacles to finalizing the merger.

The FTC’s strategy and its implications

The FTC’s approach reflects a desire to more closely control major mergers in the oil industry, where competition is essential to guarantee a free and transparent market.

By preventing John Hess from sitting on Chevron’s board, the FTC aims to reduce the risk of collusion or coordination between the major players in the oil market.

This policy is motivated by precedents in which private meetings and exchanges between executives have led to practices harmful to free competition.

In the case of Exxon and Pioneer, the FTC alleged that Scott Sheffield had participated in informal meetings with OPEC officials, helping to keep world oil production low in order to encourage higher prices.

By preventing executives like John Hess from holding influential positions in the merged companies, the FTC is seeking to prevent similar behavior in the Chevron-Hess mergers.

Implications for Chevron and Hess

For Chevron, this prohibition could limit the possibility of benefiting directly from John Hess’s expertise in the management of Guyanese assets, even if this does not call into question the company’s overall strategy.

Hess Corporation, for its part, could see its influence diminish within the new entity.

However, the acquisition remains an important lever for Chevron, which is seeking to strengthen its presence in oil-rich regions, while meeting the decarbonization requirements imposed by regulators and investors.

The FTC’s decision could also influence future mergers and acquisitions in the energy sector.

Companies will now have to anticipate possible restrictions on the participation of their executives on the boards of merged companies.

Regulators are increasingly showing their intention to protect competition in a context of growing concentration in the sector.

Outlook for the energy industry

This type of decision could prompt major oil companies to review their M&A strategies.

While mergers can help achieve economies of scale and consolidate positions in strategic markets, they are now coming under close scrutiny from regulators such as the FTC.

Companies in the sector will have to adapt their expansion plans to comply with the new rules imposed by the antitrust authorities.

The ongoing arbitration between Exxon, CNOOC and Chevron will also be decisive for the outcome of this merger.

If the acquisition is approved, Chevron will significantly strengthen its position in the Guyana region, a key area for global hydrocarbon supplies.

However, increased scrutiny from regulators could influence the way energy companies organize and manage their operations in the future.

The oil sector continues to navigate in an environment where mergers and acquisitions are perceived as potential threats to competition, but also as opportunities for growth and resource optimization.