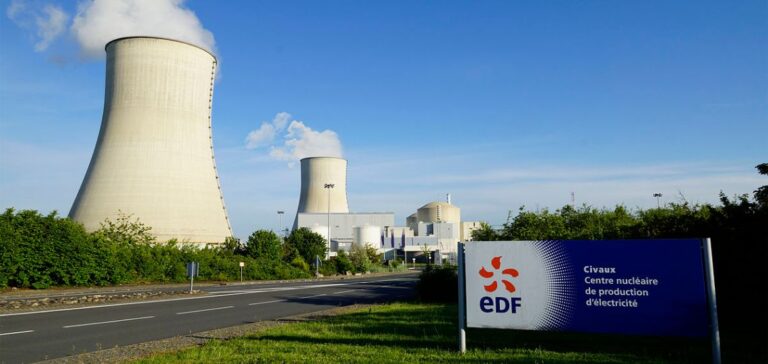

French energy companies are bracing themselves for a potential tax hike, targeting large power plants.

A proposed capacity tax, considered by the previous government, could resurface with the new administration.

This tax, which would levy 40,000 euros per megawatt on facilities exceeding 260 MW, is aimed primarily at large nuclear and gas facilities.

The stakes are high for a sector already under economic and political pressure.

Financial Impacts and Adaptation Strategies

For the energy sector, this measure could generate up to 3 billion euros in tax revenues.

EDF, whose nuclear facilities represent a total capacity of 61 gigawatts (GW), would be the most affected, with an estimated charge of 2.4 billion euros.

Engie, with 2.55 GW of installed gas and hydroelectric capacity, could have to pay around 102 million euros.

TotalEnergies would also be affected with its 2.67 GW of gas-fired power plants, for a potential amount of 106.8 million euros.

Wind and solar power plants, generally below the 260 MW threshold, would not be affected by this tax.

Political and economic context

This relaunch of the tax comes at a time when France is looking for solutions to close its budget deficits, while at the same time meeting the European Commission’s requirements regarding compliance with debt limits.

The previous attempt at a levy, the CRIM, had generated revenues well below forecasts, with only 300 million euros collected against expectations of 3 billion euros.

The stakes are therefore high for the future government, which must quickly find alternative sources of funding.

Regulatory issues and industry reactions

The companies concerned are closely monitoring regulatory developments, while the future government, headed by Michel Barnier, has yet to confirm its position on this proposal.

The Ministry of Finance has indicated that the decision to relaunch this tax will depend on the political orientation of the newly elected government.

This climate of uncertainty is forcing companies to review their budget forecasts and consider strategies to mitigate the potential impact on their profitability.

A controversial but necessary tax?

Although controversial, this tax could be seen as a necessity in the face of budgetary pressure.

It does, however, raise questions about the balance to be maintained between increased government revenues and the competitiveness of energy companies.

Industry players fear a domino effect, where higher taxation could affect not only their profitability, but also their ability to invest.

Discussions on this proposal are likely to continue as the new government clarifies its priorities.