The acquisition of Citgo Petroleum by Amber Energy, backed by Elliott Investment Management, represents a major maneuver in the U.S. refining sector. This purchase is the result of a court procedure aimed at settling the debts of Venezuela and its national oil company, PDVSA, totaling approximately USD 21.3 billion. Citgo, a strategic asset for Venezuela, is also the seventh-largest refiner in the U.S. market, with a processing capacity of 807,000 barrels per day spread across its refineries in Texas, Louisiana, and Illinois. In 2023, the company generated a net profit of USD 2 billion.

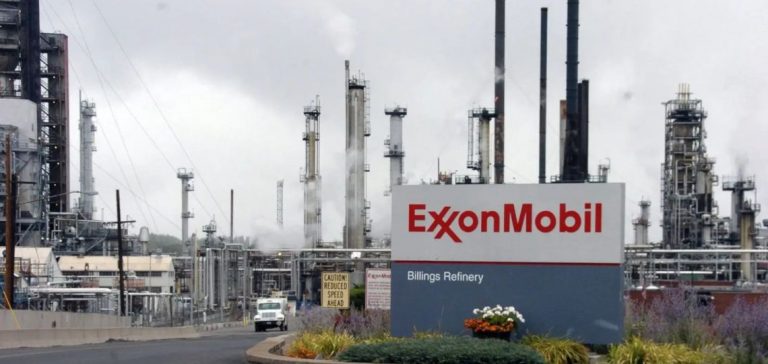

Elliott’s interest in Citgo stems from various unpaid debts owed by Venezuela, which pushed creditors to seek compensation through the auction of shares in PDV Holding, Citgo’s parent company. Amber Energy, led by Gregory Goff, former CEO of Marathon Petroleum and current Exxon Mobil board member, was designated as the main bidder in the auction. The acquisition price proposed by Amber, valued at USD 7.28 billion, is far from covering the total claims but would release part of the expected payments for international creditors.

A complex acquisition with repercussions for the U.S. market

Citgo’s purchase raises several questions about competition and industrial strategy in the United States. Citgo and Exxon Mobil are direct competitors in the motor fuels and lubricants market, and Gregory Goff’s involvement, as Exxon’s current director, in this acquisition through Amber Energy could draw the attention of federal regulators. Any excessive concentration in the refining sector could be perceived as a market imbalance, prompting the Federal Trade Commission (FTC) to closely examine the implications of this transaction.

Citgo’s position in the U.S. market remains strategic: the company owns a network of 4,200 independent retailers, significant storage infrastructure, and a pipeline network that enables it to effectively serve several regional markets. With Elliott’s financial support, Amber could restructure Citgo to optimize the profitability of its assets, possibly through the sale of less profitable segments. However, the shadow of new legal disputes with other Venezuelan creditors looms over this transaction, complicating the company’s governance and limiting its short-term operational flexibility.

Gregory Goff: A key figure for Amber Energy

Gregory Goff, with 40 years of experience in the energy sector, plays a crucial role in this operation. After a career marked by his leadership positions at Marathon Petroleum and Andeavor, where he led significant restructurings, Goff is also recognized for his ability to maximize asset value in a competitive environment. His appointment as CEO of Amber Energy reflects Elliott’s desire to place experienced leadership at the head of Citgo to navigate through this complex context.

Amber Energy, while positioning itself as an independent entity, could benefit from the long-standing collaboration between Goff and Elliott. The most notable example is the successful split of Marathon Petroleum’s Speedway division, which led to its sale to 7-Eleven for USD 21 billion in 2021. This strategy could be replicated with Citgo, particularly if Amber decides to sell some of Citgo’s assets to maximize short-term returns while streamlining the main refining operations.

Geopolitical implications of Citgo’s acquisition

Citgo is not just an oil asset: its control has long been a major geopolitical issue between the United States and Venezuela. Since the Trump administration recognized Juan Guaidó’s interim government in 2019, control of Citgo has remained contested. Amber Energy’s takeover could thus change the situation, further isolating the Nicolás Maduro regime, which would lose a key asset for its international finances. Moreover, Elliott, a well-known activist fund for its aggressive stances, could exacerbate tensions with other creditors seeking to recover their funds through ongoing legal battles.

The issue is also strategic for the United States, which seeks to secure its fuel supply and reduce its dependence on energy sources considered “at risk.” By integrating Citgo into Amber’s portfolio, the United States could strengthen its position in the fuel market while reducing Venezuela’s influence in the American refining sector.