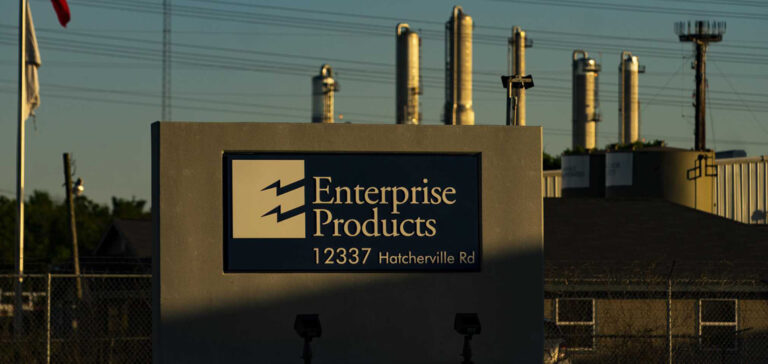

Enterprise Products, a Houston-based pipeline operator, has unveiled plans to invest $3.1 billion in infrastructure projects to support rising liquefied natural gas (LNG) production in the Permian Basin. With LNG production in the Permian Basin forecast to increase by 700,000 barrels per day (bpd) by 2023-2025, Enterprise is taking proactive steps to ensure that the necessary infrastructure is in place to facilitate transportation and processing.

Seminole Pipeline Conversion

One of the key initiatives includes the conversion of the Seminole pipeline, which currently transports crude oil, to carry LNG by December 2023. The Seminole pipeline, with its current capacity to transport 210,000 bpd of crude oil, will play an essential role in LNG transport once the conversion is complete.

Bahia Pipeline Project

Enterprise Products is also investing in the construction of a 550-mile Bahia pipeline. This pipeline will have the capacity to transport 600,000 bpd of LNG from the Delaware and Midland basins to the Enterprise fractionation complex in Chambers County, Texas. It is scheduled to enter service in the first half of 2025. This strategic decision was taken in lieu of partial looping of the Shin Oak pipeline, which would have added only 275,000 bpd. According to co-CEO Jim Teague, Enterprise believes the Bahia pipeline is the right size to meet their needs.

Gas Fractionation Units and Gas Treatment Plants

In addition to pipelines, Enterprise Products is investing in a gas fractionation unit and two gas processing plants. These facilities are scheduled to come on stream in 2025. The fractionation unit in Chambers County, Texas, will be capable of fractionating 195,000 bpd of LNG, with an associated deisobutanization unit capable of separating 100,000 bpd of butane.

Expansion in Natural Gas Processing

Enterprise has already begun construction of two announced natural gas processing plants, the Orion plant in the Midland Basin and Mentone 4 in the Delaware Basin. The two plants will have the capacity to process 300 million cubic feet per day (MMcf/d) of natural gas and extract 40,000 bpd of LNG. These plants are scheduled to come on stream in the second half of 2025, further strengthening Enterprise’s processing capacities in the Midland and Delaware basins.

Focus on Quality and Record Performance

With year-on-year transport volumes on the rise, Enterprise Products has also shifted its focus to crude oil quality specifications. The company monitors crude oil receipts to ensure they meet specifications that reflect the Platts Dated Brent specification, underlining the importance of maintaining high quality standards in global markets. Crude oil quality has also improved on the Eagleford system, making it easier to sell and improving prices.

Enterprise Products’ significant investments in infrastructure projects demonstrate its commitment to meeting the growing demand for liquefied natural gas (LNG) in the Permian Basin. With LNG production set to increase significantly over the next few years, these initiatives will play a crucial role in ensuring the efficient transport and processing of this valuable resource. In addition, the company’s focus on maintaining high quality standards underscores its dedication to serving global markets and ensuring the desirability of U.S. Gulf Coast crude oil. These efforts position Enterprise Products as a key player in the ever-changing energy landscape.