Energy Exploration Technologies Inc. (EnergyX) announced it has entered into a binding conditional agreement to acquire 100% of shares in Daytona Lithium Pty Ltd, a fully-owned subsidiary of the Australian company Pantera Lithium Limited (listed ASX: PFE). The transaction, valued at AUD40mn ($27mn), will provide EnergyX complete rights to approximately 35,000 acres of potential lithium resources situated in the geological formation of Smackover, in the US state of Arkansas. With this purchase, EnergyX expands its available land to nearly 50,000 acres in this strategic region.

Strategic integration into the Lonestar™ project

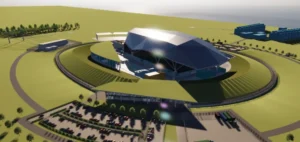

This operation is part of EnergyX’s flagship Lonestar™ project development, currently based in Northeast Texas on the same geological Smackover Formation. The Lonestar™ project aims to produce 50,000 tonnes per annum of lithium hydroxide by 2030, with an initial operational phase estimated at 12,500 tonnes per annum beginning in 2028. EnergyX already owns a 330-acre site near the Red River Army Depot intended for a large-scale refinery to process extracted lithium.

The recently acquired Daytona Lithium resources will directly strengthen supply capabilities for the Lonestar™ project, enabling EnergyX to accelerate the development of its integrated lithium supply chain in the United States. The company has already validated lithium samples produced at its pilot facility in Austin with battery cathode manufacturing clients.

Financial terms and transaction timeline

According to details released by EnergyX, the purchase agreement signed on July 4, 2025, includes payment split between cash and ordinary shares of EnergyX. An initial sum of AUD6mn ($4mn) will be paid in cash, divided into three installments. The remaining AUD34mn ($23mn) will be paid in EnergyX shares valued at $9.50 each (equivalent to AUD14.50 per share), representing the issuance of 2,344,828 shares to Pantera Lithium Limited.

The transaction remains subject to thorough due diligence and approval by Pantera Lithium shareholders. EnergyX expects to complete the acquisition definitively during the third quarter of 2025.

Technical support from Worley and technological integration

To carry out this industrial project, EnergyX will benefit from technical support from Worley, an international company specialising in engineering, procurement, and construction services in energy and chemicals sectors. Worley will contribute its recognized expertise in lithium engineering to support the operational development of the Lonestar™ project.

EnergyX will also leverage its patented LiTAS® (Lithium Ion Transport and Separation) technology, specialising in Direct Lithium Extraction (DLE). This method combines adsorption, solvent extraction, and selective membrane technology to enhance lithium recovery rates and reduce operational costs. LiTAS® technology is intended to enable EnergyX to optimise the industrial yield of the Lonestar™ project, thus reinforcing strategic US independence in lithium supply.