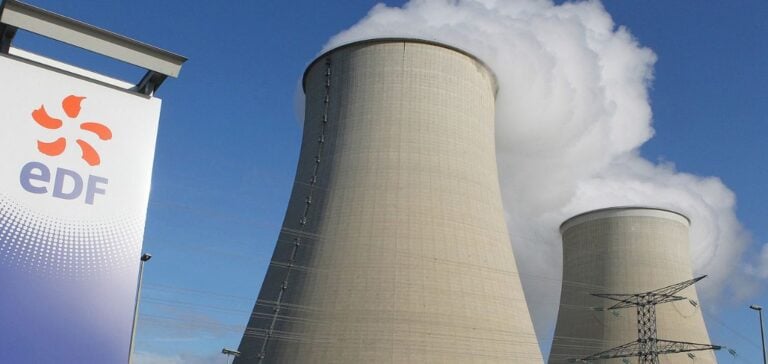

EDF, Europe’s leading electricity producer, expects nuclear power generation in 2024 to be at the upper end of its forecast range, between 315 and 345 TWh.

This optimistic outlook is based on increased reactor availability, contributing to a marked drop in electricity prices.

In the first half of 2024, nuclear output rose by 12.2% year-on-year to 177.4 TWh, thanks to a robust operating performance.

Flamanville-3 and Ambitions 2035

The Flamanville-3 reactor is about to enter service, marking the launch of the first new nuclear reactor in France for several decades.

This development is central to EDF’s “Ambitions 2035” strategic plan, which aims to meet the challenges of the energy transition with increased levels of performance and investment.

EDF is preparing for “abundant” and “competitive” electricity in the long term, having already signed agreements representing over 10 TWh/year with industrial partners.

Impact of Maintenance Work and Export Records

Since March, maintenance work by RTE (Réseau de Transport d’Électricité) has limited interconnection capacity with neighboring countries to the east, temporarily affecting electricity prices in France.

Despite these limitations, France exported a record 50 TWh in the first half of the year.

Hourly electricity prices were zero or negative for 347 hours, compared with just 67 hours in the first half of 2023.

Commercial and Regulatory Strategy

EDF is preparing for new commercial and regulatory arrangements beyond the ARENH mechanism, covering its current fleet of reactors until the end of 2025.

In France, EDF has already signed letters of intent for more than 10 TWh/year with industrial partners, and nearly 2,200 contracts covering around 13 TWh for 2028 and 7 TWh for 2029.

This strategy is part of a wider framework to help customers reduce their carbon footprint, produce more low-carbon electricity and develop flexibility solutions to meet the demands of the power system.

Renewable Capacity Expansion and International Projects

EDF continues its expansion in renewable energies with the commissioning of 1 GW of new wind and solar capacity in the first half of 2024, bringing its total capacity to 15.3 GW.

In France, EDF’s Enedis unit connected 2.5 GW of new renewable capacity to the grid.

Internationally, EDF is developing major projects such as the 1.5 GW Al Ajban offshore wind farm in the United Arab Emirates and the 4.5 GW wind and solar project in Oman.

Hiring prospects and future plans

EDF plans to recruit 20,000 new employees in France this year, with a focus on nuclear and energy transition skills.

In the UK, EDF continues to work on the Hinkley Point C nuclear power plant project, with the two reactors scheduled to come on stream between 2029 and 2031.

In addition, the Sizewell C project, now fully funded by the UK government, is progressing with a majority stake of 76.1% for the government and 23.9% for EDF.

EDF anticipates significant growth in nuclear generation and renewable capacity, while navigating in an environment of falling electricity prices.

With ambitious projects and a clear strategy, EDF is positioned to play a central role in the global energy transition.