The number of dam projects in Africa is increasing. Eight of the continent’s largest dams are currently under construction or under development. For a long time, Africa suffered not only from a lack of development in the steel industry, but also from a wide variety of weather conditions. Today, some countries are sounding the death knell and want to make the most of their water resources. An overview of the largest hydroelectric projects on the African continent.

Top 8 largest dam projects in Africa

Laúca dam – 2070 MW

The Laúca dam is the second largest gravity dam currently under construction in Angola. Like the Caculo Cabaça dam, it will be located on the Kwanza River in the north of the country. The dam will have an installed capacity of around 2070 MW and a height of some 132 metres. The dam will supply electricity to 10 of Angola’s 18 provinces.

Under construction since 2012, it will enter service in a few months’ time. Last December, we learned that the sixth and final turbine was now operational.

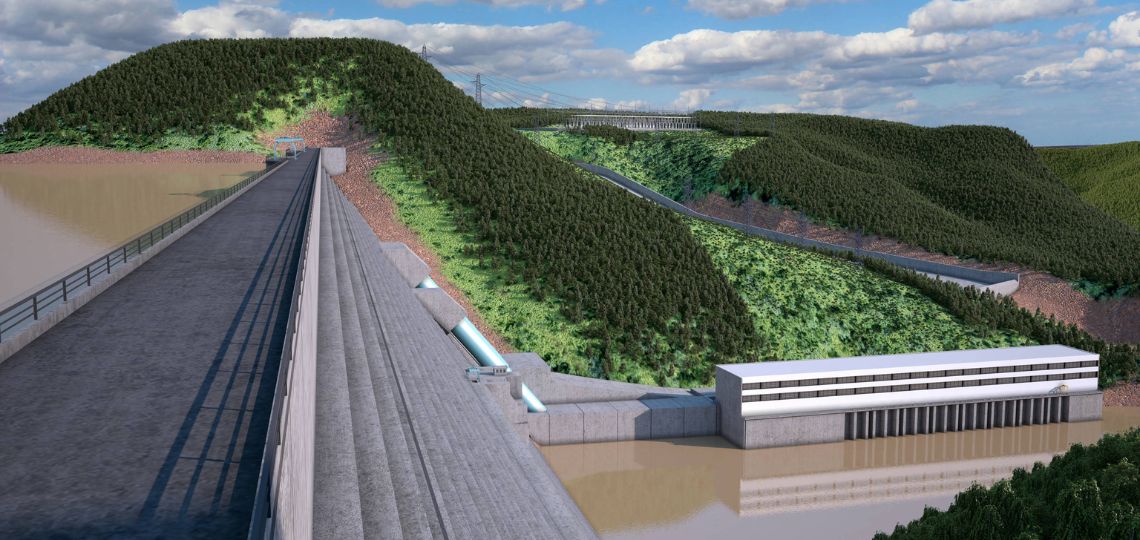

Rufiji dam – 2115 MW

Tanzania is also keen to establish itself as a key player in power generation. To this end, it is developing the Rufiji dam, also known as Stiegler’s gorge dam.

The latter is currently under construction on the Rufiji River and is set to become one of the largest and most important dams on the continent. With a capacity of 2,115 MW and a height of 134 m, the gravity dam will generate 5.92 TWh/year.

Commissioning is scheduled for 2022. However, many estimates point to a delayed commissioning date of 2027. And for good reason: the project is highly controversial, due to its very high construction costs and high environmental impact.

Koysha dam – 2160 MW

Also known as the Gilgel Gibe IV dam, the Koysha gravity dam is a project currently under construction. It will be located on the Omo River in Ethiopia. With an installed capacity of 2160 MW, it will be the second largest dam in Ethiopia, behind the Renaissance Dam.

With the arrival of these two megaprojects, Ethiopia is demonstrating its ambition to become a middle-income country by 2025. In the same year, the country hopes that the entire population will have access to electricity.

These objectives are part of the company’s Growth and Transformation Plan II, which aims to develop the country’s economy. And to diversify its energy mix.

Caculo Cabaça dam – 2172 MW

The Caculo Cabaça dam is a gravity dam currently under construction on the Kwanza River in Angola. When delivered in 2024, it will be one of the largest dams in Africa. It will have an installed capacity of 2172 MW and a height of some 103 metres.

In addition, the installed capacity will be divided into four main turbines, each rated at 530 MW, and a 52 MW accessory turbine. The five turbines will be Francis vertical-axis turbines. Average electricity production for the entire hydroelectric plant is estimated at 8566 GWh/year.

Batoka Gorge dam – 2400 MW

The Batoka Gorge dam is a project currently under development. If built, it will be located on the Zambezi River, between Zambia and Zimbabwe. This long-awaited project will develop a capacity of 2,400 MW. This offers strong electrical potential for both countries, which are in great demand. As of July 2018, the projected development cost was estimated at $4.5 billion.

However, it seems that local populations are strongly opposed to the project. And for good reason: the local population will not benefit from this electricity. It will be destined for the Southern African Power Pool (SAPP).

What’s more, the environmental factor is also controversial. The dam could cause the river to recede to within 650m of Victoria Falls, a UNESCO World Heritage Site.

Mambila dam – 3050 MW

The Mambila dam is a hydroelectric megaproject due to be built soon in Nigeria. Construction of the dam was due to start last year, but it is still in the planning stage.

And for good reason: this enormous infrastructure is expected to displace 100,000 people in the state of Tabara. This situation has made several development partners reluctant to finance the project.

Nevertheless, it is estimated that construction of the dam will cost a total of $5.8 billion.

The dam, which has been planned for over 30 years, will be connected to three dams on the Donga River in Taraba State. The plant will have a total capacity of 3,050 MW.

Renaissance dam – 6450 MW

The Renaissance Dam is a mega-dam currently under construction on the Blue Nile in Ethiopia. With an installed capacity of 6450 MW, it should be the largest hydroelectric dam in Africa if the Inga III project does not go ahead.

However, the Renaissance Dam is also the subject of much controversy. It is a source of tension with Egypt and Sudan. The latter fear a reduction in water flows and silt inputs. Not least because 90% of the freshwater used by Sudan and Egypt comes from the Nile.

Inga III dam – 39,000 MW

The Inga III dam, also known as Grand Inga, will be located in the Democratic Republic of Congo (DRC). For the moment, it’s still a project. However, it could well surpass all existing power plants, with an installed capacity of 39,000 MW, almost twice the capacity of theThree Gorges Dam.

Despite the grandeur of the project, construction has been postponed for several years, mainly for financial reasons. There is also a great deal of dissension between the various stakeholders. Controversies are also raging over the inevitable displacement of populations during construction.

Nevertheless, the DRC ambassador to Ethiopia hinted last February that construction of the dam could start before the end of 2021.

Towards a new landscape for the hydraulics industry

In short, these hydroelectric dam projects, with their spectacular performance and size, testify to the growing development of the hydropower market in Africa. The continent wants to meet the growing needs of its population. In this sense, the development of electricity on the African continent is an absolute priority for certain countries.

This is the case for the DRC and Ethiopia, which intend to benefit greatly from the strength of their rivers. And this despite opposition from all sides. Whether local or international.

45% of the world’s dams are currently Chinese

What’s more, the distribution of hydroelectric power plants and their dams is not equal in all regions of the world. In fact, the four main dam-building countries account for three quarters of the total: 45% in China, 14% in the USA, 9% in India and 6% in Japan. France has 569 large dams, or 1% of the world total.

However, the arrival of major infrastructures on the African continent could well redraw the global distribution of developed hydroelectric power. This is to the benefit of the African continent, which is tending to diversify its energy mix towards greener energies.