Discussions at the 29th United Nations Climate Change Conference (COP29), held in Baku, Azerbaijan, marked a pivotal moment for international carbon markets. Participants adopted rules for two distinct mechanisms defined under Article 6 of the Paris Agreement, but questions persist about their application and effectiveness.

The decentralized mechanism under Article 6.2 allows countries to negotiate carbon credits directly through bilateral frameworks. Meanwhile, Article 6.4 introduces a centralized market, managed by the United Nations, to oversee the issuance and transfer of carbon credits. The International Emissions Trading Association estimates that these mechanisms could save up to $250 billion annually by 2030 in meeting climate goals.

Lack of Uniform Framework for Article 6.2

Even before the official adoption of rules, countries like Singapore, Japan, and Switzerland had already established bilateral agreements to begin international exchanges. However, no uniform approach has been adopted, posing a risk of fragmented standards.

Singapore relies on existing standards, such as those from voluntary programs like Verra and Gold Standard, while Japan develops its own certification standards. Experts believe this diversity could harm the integrity and demand of the decentralized market.

To address this issue, initiatives like the Carbon Credit Quality Initiative (CCQI) and the Integrity Council for the Voluntary Carbon Market (ICVCM) aim to assess carbon credit quality and promote consistent standards.

Challenges of Article 6.4

Designed to address the shortcomings of the Clean Development Mechanism (CDM), Article 6.4 aims to ensure greater integrity in carbon credits. However, some experts highlight that credits derived from CDM projects risk undermining the credibility of this new framework if used without substantial changes.

The first methodologies under this mechanism are expected to be submitted by mid-2025, with credits available between 2025 and 2026. However, questions remain about penalty mechanisms for countries that fail to comply with the rules.

The Environmental Defense Fund (EDF) calls for stricter standards for nature-based projects to protect local communities and indigenous peoples.

Insufficient Policy Signals

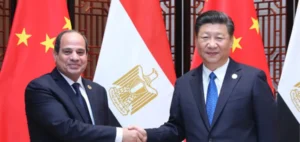

The implementation of carbon markets under Article 6 also depends on national policies. However, many countries, including China and Australia, struggle to provide clear guidelines to the private sector.

In Australia, the Carbon Market Institute highlighted the urgency of deciding whether the country fully engages in international markets or focuses on local initiatives. In China, a carbon sector entrepreneur noted that the country could become a buyer of carbon credits under the Belt and Road Initiative, but the lack of government directives hinders current efforts.

These gaps in national policies risk slowing private sector participation, jeopardizing the long-term effectiveness and viability of Article 6 mechanisms.