Bulgargaz is at the heart of strategic discussions with Botas, the Turkish gas transmission company.

The aim is to renegotiate a liquefied natural gas (LNG) supply contract signed in January 2023.

This agreement, designed to reinforce Bulgaria’s energy security following the suspension of Russian supplies in 2022, is now coming under increasing criticism for its lack of relevance to the country’s energy needs.

Background and challenges

The terms of the initial agreement, hailed as a quick fix to compensate for the halt in Russian deliveries, are now being called into question.

Influential voices within the Bulgarian energy sector are denouncing the underperformance of expected deliveries, prompting parliament to mandate the Minister of Energy to renegotiate the terms of the agreement.

Critics point to a lack of flexibility and a mismatch between the volumes delivered and actual market demand in Bulgaria.

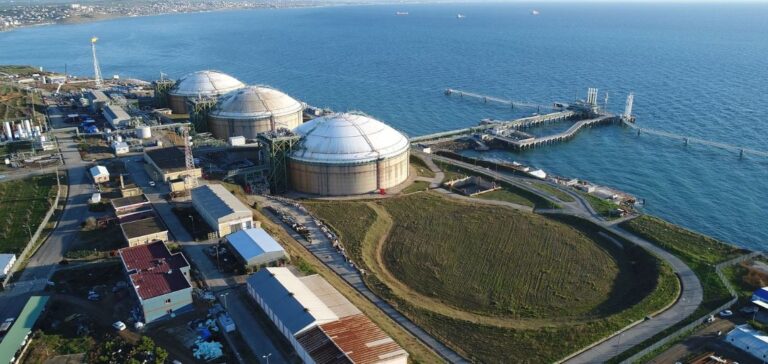

Turkey, with its regasification infrastructure and gas shipping capacity, plays a crucial role in this dynamic.

With an annual send-out capacity of 30 million tonnes, Turkey can absorb part of the Bulgarian surplus, making it easier to redirect flows towards European markets.

Negotiations and outlook

The interconnection agreement between Bulgartransgaz, the Bulgarian gas transmission system operator, and Botas, signed in January 2023, illustrates Bulgaria’s desire to secure its supply by diversifying its sources.

The Strandzha/Malkoclar crossing on the Bulgarian-Turkish border thus becomes a strategic node for gas supplies not only to Bulgaria, but to the entire region.

Current talks between Bulgargaz and Botas aim to adjust this agreement to meet market requirements, while ensuring greater stability of supply.

Against this backdrop, Bulgaria continues to broaden its supplier base, notably via imports from Azerbaijan, and via regasified LNG delivered via Greece and Turkey.

This strategy aims to further reduce the country’s historical dependence on Russian hydrocarbons.

The progress of negotiations between Bulgargaz and Botas could determine the next stage in regional energy integration.

At a time when LNG prices remain high on the spot market in the Eastern Mediterranean, this renegotiation comes at a crucial time for Bulgaria, as it seeks to establish itself as a key player in energy security in Southeast Europe.