Bayridge Resources Corp. has entered into a definitive agreement to acquire a 51% stake in the Baker Lake uranium project, located in the Kivalliq Region of Nunavut. The project spans 619 km² across 83 contiguous claims and lies approximately 60 kilometres south of the town of Baker Lake. The transaction, valued at $1.4mn, will be executed through the issuance of 5,600,000 common shares of Bayridge at a deemed price of $0.25 per share.

High geological potential project

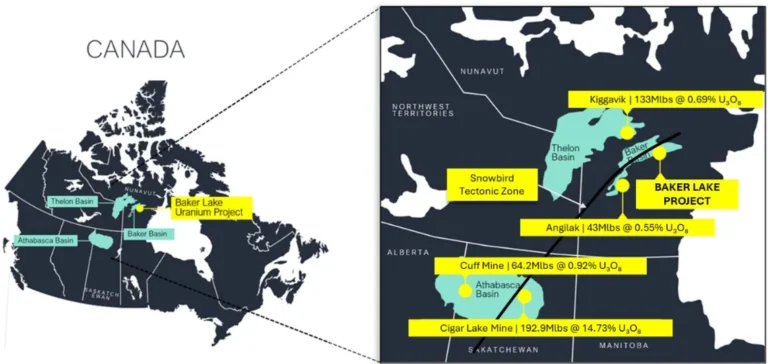

The Baker Lake project is situated in a Paleoproterozoic district known for its uranium deposits, including Angilak, owned by Atha Energy Corp., and Kiggavik, operated by Orano. The uranium is hosted in Kazan Formation sandstones and structural corridors, showing geological similarities to other major projects in the area. Historic exploration identified 20 uranium prospects along 75 kilometres of unconformity within the Baker Basin.

A 2008 TEMPEST® airborne survey identified 30 priority uranium targets, highlighting conductive structures and fault corridors associated with strong uranium radiometric trends. Previous drilling returned notable intercepts, including 17.3 metres at 0.30% U₃O₈ and 15.3 metres at 0.20% U₃O₈, with a 0.9-metre section grading 2.74% U₃O₈.

Acquisition terms and joint venture structure

The acquisition will be completed through the purchase of 51% of the shares in privately held 1461433 B.C. Ltd, which holds 100% of the project. Bayridge will have a right of first refusal over the remaining 49%. Following closing, Bayridge and the private company will enter into a joint venture agreement, with the latter retaining a free-carried interest until a pre-feasibility study is completed. Each party will appoint one director to the other’s board.

The current shareholders of Privco will hold a 43% interest in Bayridge Resources upon completion. No new control blocks will be formed, and the transaction remains subject to regulatory approval, including clearance from the Canadian Securities Exchange.

Previous exploration and infrastructure

Exploration work on site includes approximately 7,851 line-kilometres of airborne geophysics and over 5,500 metres of modern drilling. Based on current cost equivalents, these efforts represent over $7mn in exploration value. In addition, 23.5 km² of detailed surface mapping grids have been implemented to delineate high-potential areas.

Surface programmes also yielded high-grade samples reaching up to 1.83% U₃O₈. Several priority geophysical targets, including untested electromagnetic conductors, remain open for future drilling campaigns.