Asian refiners express their preference for an extension of OPEC+ production cuts to the end of 2024. Stable oil prices and refining margins are their main concerns, rather than security of crude supply. Geopolitical tensions in the Middle East and prolonged OPEC+ production cuts have not caused shortages of crude or raw materials in Asia.

Impact of geopolitical conflicts

Geopolitical conflicts involving Israel and Iran, as well as sanctions against Russia and Iran, have not disrupted crude supplies to Asian refineries. Product marketing managers, raw materials managers and refinery representatives in Thailand, Japan, South Korea, China and India stress the importance of stable oil prices and refining margins.

Outlook for Asian refiners

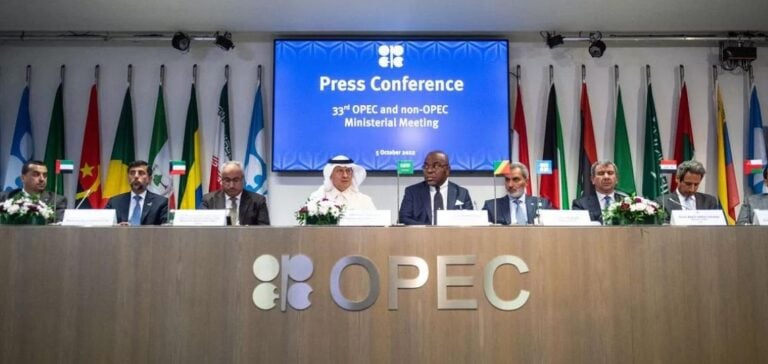

For Asian refiners, the ideal outcome of the OPEC+ ministerial meeting on June 2 would be to maintain the current production cut. Any surprise price spike in the second half of the year could hurt oil demand and refining margins in Asia.

High refining margins

Refining margins and inventory valuations are major concerns for Asian refiners. Lower oil prices do not necessarily favor Asian refineries, as they can lead to losses in inventory valuation and negatively affect product sales margins. Price stability is therefore essential to maintain healthy refining margins.

Economic performance and challenges

Economic activity in Asia has been weaker than expected this year, putting pressure on light and middle distillate spreads. Demand for industrial fuel in Asia is weak, resulting in lower cracking margins for diesel and jet fuel. Domestic refining margins and export margins in South Korea have been in decline since February.

Risk management strategies

Asian refiners, including Bharat Petroleum Corp. Ltd, Thai Oil, ENEOS and S-Oil, hope that OPEC+ will maintain a strict production control strategy to balance supply and demand. Although Asian refiners have no major crude supply security problems, they rely on stable prices and margins to effectively plan their operations and market strategies.

Security of supply considerations

Asian refinery managers say they have no problem securing monthly barrels from major Persian Gulf suppliers. OPEC+ cuts have never caused a shortage in crude supplies to Asian refiners, thanks in large part to the large volumes of Russian and Iranian oil purchased by China and India.

Analysis and future prospects

The balance between oil prices, refining margins and security of supply is essential for Asian refiners. As market players await the outcome of the OPEC+ meeting on June 2, the decisions taken will have a major impact on market dynamics and the competitiveness of refiners in Asia.

Asian refiners will continue to monitor geopolitical developments and OPEC+ production policies to adjust their strategies and maintain stable operations.