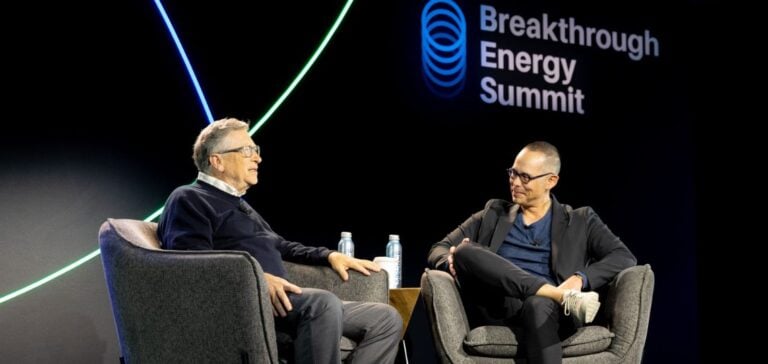

Microsoft co-founder Bill Gates recently hosted the Breakthrough Energy summit in London, showcasing over 100 innovative companies aiming to reduce greenhouse gas emissions. At the event, Gates called for greater investor support for these technologies, describing them as profitable and potentially revolutionary for the industry. In the past, Bill Gates had already shown his optimism about climate innovation.

Bill Gates, via his Breakthrough Energy Ventures fund, has invested around $2.2 billion since 2015 in innovations such as low-carbon cement, zero-emissions aviation and sustainable building materials. Although many of these technologies are still in the development phase, Gates stresses the importance of financial investment to catalyze their progress.

Debate on Ecological Innovation

Innovation in the ecological field has been criticized by some as a costly distraction from the immediate measures needed to reduce greenhouse gas emissions. However, Gates remains convinced that innovation can make a significant contribution to this cause. “I think things can move forward thanks to human ingenuity,” he declared.

Less than ten years ago, investor interest in climate technologies was limited. However, the first edition of Breakthrough Energy in 2022 marked a turning point, with the likes of Jeff Bezos and Jack Ma joining Gates to raise substantial funds. In 2024, the event attracted around 1,500 executives from banks, investment funds and major corporations, all interested in the promising innovations on display.

Growing investor interest

Technologies presented at the summit included hydrogen aircraft engines from ZeroAvia, low-carbon steel from Boston Metal, and advances in nuclear fusion by Commonwealth Fusion Systems. Tim Heidel, CEO of Veir, emphasized the enormous economic potential of these technologies, believing they could give rise to some of the world’s biggest companies.

John Kerry, former US climate envoy, also attended the summit, calling for massive private support to tackle climate challenges. In his view, state funding will not be enough, and technological innovation will be crucial to mobilizing the necessary resources.

Urgent Action

At the same time, diplomatic climate talks are struggling to reach a conclusion, with rich and poor countries unable to agree on the financing needed to combat climate change. Julia Reinaud, head of Europe at the summit, warned that there was not enough time to develop these technologies, and stressed the need for rapid adoption.

Bill Gates and other industry leaders believe that we are on the cusp of a green industrial revolution, similar to those of the past but geared towards sustainability. Investor support will be decisive in transforming these innovations into viable, widely adopted solutions.

**Long tail:** Green industrial revolution.

**Meta-description:** Bill Gates calls on investors to support green technologies, crucial to reducing greenhouse gas emissions and promoting a green industrial revolution.

**Countries mentioned:** United Kingdom, United States, China.

**Companies and organizations mentioned:** Microsoft, Breakthrough Energy Ventures, ZeroAvia, Boston Metal, Commonwealth Fusion Systems, Veir, United Nations.

**Tags:** Bill Gates, Breakthrough Energy, green technologies, greenhouse gas emissions, climate investments, green innovation.

**Thematic:** Sector innovation.

**Photo ideas:**

1. Bill Gates at the Breakthrough Energy summit, addressing investors.

2. Presentation of a green technology, such as a hydrogen aircraft engine or a nuclear fusion prototype.