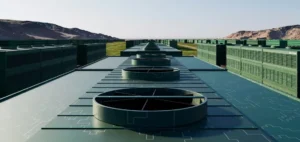

“Mammoth” represents a significant leap forward compared with its predecessor “Orca”, with ten times the capacity. The new plant can remove 36,000 tonnes of CO2 from the atmosphere every year. That’s the equivalent of taking 7,800 combustion engine cars off the road every year. The plant’s modular design comprises 72 collector containers, of which only 12 are currently in operation.

Energy and environmental impact

Icelandic geothermal energy powers the entire “Mammoth” operation, demonstrating a remarkable sustainable climate solution. The captured CO2 is turned into stone and stored underground. This method promises a lasting reduction in atmospheric carbon emissions.

Debates on economic viability

Although promising, direct air capture (DAC) technology remains controversial, mainly because of its high cost, estimated at nearly $1,000 per tonne of CO2 captured. According to Jan Wurzbacher, co-founder of Climeworks, reducing this cost to around $100 per tonne by 2050 could make the technology economically viable. However, critics such as Lili Fuhr of the Centre for International Environmental Law warn of the ecological risks and uncertainties associated with this technology.

Recognition and global expansion of DAC

Despite criticism, DAC technology is gaining traction worldwide. In the USA, start-up Occidental announced last year its intention to build an even larger DAC plant, named STRATOS, capable of removing 500,000 tonnes of CO2 per year.

“Mammoth” marks a significant step forward in the fight against climate change, thanks to technological innovations in carbon capture. Its success or failure could influence future environmental policies. But also to shape the trajectory of global efforts to reduce emissions.