The International Energy Agency (IEA) has published a report revealing that European imports of liquefied natural gas (LNG) have increased by 63% in 2022, due to the drying up of Russian pipelines. This strong demand has driven up prices and led to the global LNG market doubling in value by 2022, reaching a record $450 billion.

The United States provides two-thirds of the additional flow

The IEA states that LNG volumes imported into Europe have increased by 66 bcm, with the US providing two-thirds (43 bcm) of this additional flow. Other suppliers are Qatar, Egypt, Norway, Angola and Trinidad and Tobago. The IEA also reports 2 billion m3 delivered by Russia.

More than 30 tankers full of LNG on standby

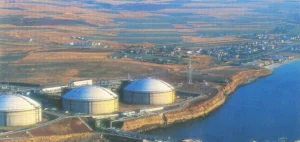

At the end of the year, at the height of this LNG race, with storage sites full and the winter mild, “more than 30 tankers full of LNG” were waiting to “hook up to gasification facilities in Europe rather than sell their cargo cheaper elsewhere,” according to the IEA.

The war in Ukraine has also boosted demand for LNG terminals and tankers. Orders for gas tankers have more than doubled (+130% compared to 2021) and reached a record 165 in 2022, according to Refinitiv data cited by the IEA, which states that Chinese shipyards have garnered more than a third of global orders.

Global gas consumption is contracting

In total, global gas consumption (LNG and pipeline gas) has contracted by 1.6% in 2022 to 4.042 billion m3. It should stagnate this year, according to the IEA, which emphasizes the uncertainties weighing on this market and particularly on the Chinese economy.