Niger’s military government has announced its decision to sell uranium extracted by Société des mines de l’Aïr (Somaïr) on the international market, following the company’s nationalisation in June. This move marks a break with French group Orano, the former majority stakeholder with a 63.4% share, while the Nigerien state held 36.6%.

A strategic shift toward new partners

The ruling junta, in power since July 2023, states its intent to assert sovereign control over the country’s mineral resources. General Abdourahamane Tiani declared Niger’s right to sell its production “to whoever wishes to buy, within market rules, with full independence,” according to state broadcaster Télé Sahel. Niamey is reportedly seeking new partnerships, naming countries such as Russia and Iran, with Moscow having expressed interest in Nigerien uranium as early as July.

Orano’s loss of operational control over its Nigerien subsidiaries was formalised in December 2024. In addition to Somaïr, this includes Compagnie minière d’Akokan (Cominak), closed since 2021, and the large Imouraren deposit, one of the world’s largest uranium reserves, estimated at 200,000 tonnes. The Nigerien government revoked Orano’s exploitation permit for the latter.

Legal dispute over Somaïr operations

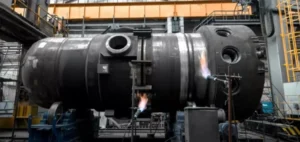

In response, Orano initiated several international arbitration proceedings against the Nigerien state. In September, a tribunal reportedly ruled in favour of the French company regarding Somaïr. According to Orano, the court prohibited Niger from selling uranium produced at the site. The company states that approximately 1,300 tonnes of concentrate are currently stored there, with a market value estimated at €250mn ($270mn).

Despite the injunction, West African media sources reported that a convoy of 1,000 tonnes of uranium had departed the northern town of Arlit, where Somaïr is located, heading to the port of Lomé in Togo via Burkina Faso. These claims remain unverified by independent sources and indicate a possible attempt by the junta to bypass current international legal restrictions.

A globally strategic uranium producer

According to 2021 figures from the European Supply Agency (ESA), Niger accounted for 4.7% of global natural uranium production. This positions the country as a significant player in a geopolitical context where energy independence remains a priority for many nations.

The dispute between Niamey and Paris over resource control reflects a broader realignment by several African countries in their relations with former colonial powers.