The global battery energy storage systems (BESS) market is expected to reach $99.67bn by 2033, based on projections of a 28.8% compound annual growth rate starting in 2025. This growth is primarily driven by the expanding use of renewable energy sources and the increasing demand for grid flexibility worldwide.

Acceleration of investment in electricity networks

Power infrastructure is shifting rapidly toward intermittent sources such as wind and solar, requiring grid operators to invest in systems that can offset supply fluctuations. Large-scale installations like the Hornsdale Power Reserve in Australia and the Moss Landing Energy Storage Facility in the United States illustrate the trend toward storage solutions that enhance grid reliability.

Government incentives further support this development, notably through the United States’ Inflation Reduction Act (IRA), the European Union’s Green Deal and Japan’s subsidy programmes for stationary storage. These policies encourage investments in both utility-scale and decentralised storage projects while also fostering technological innovation.

Industrial outlook and technical challenges

The industrial segment is experiencing significant growth with an expected annual rate of 29.8% through 2033, driven by the electrification of production processes and the demand for stable power supply. This translates into greater adoption of storage systems in manufacturing sites, particularly in emerging economies and high-demand regions.

Among evolving technologies, flywheel batteries are expected to see an annual growth rate of 30.7%, fuelled by the demand for high-power, fast-response storage solutions. Despite this progress, high upfront costs and the gradual degradation of batteries remain obstacles for operators, particularly in terms of long-term profitability.

Regional dynamics and industrial expansion

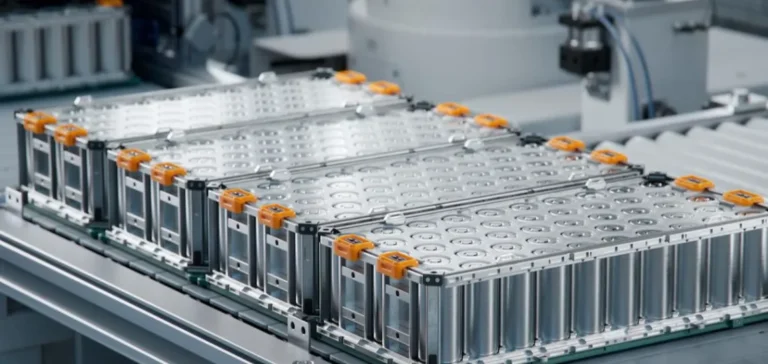

The Asia-Pacific region accounted for 44.8% of global BESS market revenue in 2024, driven by major grid modernisation efforts and fast renewable energy adoption. Initiatives such as the new grid-scale battery manufacturing facility opened by Fluence Energy in Ohio in September 2025 aim to strengthen domestic production capacity and meet the rising demand for utility-scale storage.

Expansion prospects are unfolding in a global energy transition context, with growing demand for storage technologies to stabilise electricity supply. Industrial players are working to consolidate their positions in strategic markets where regulation, innovation and local manufacturing capabilities are becoming decisive competitive levers.