U.S.-based NANO Nuclear Energy Inc., listed on NASDAQ, has released its financial results for the first nine months ending June 30, 2025. The company reported cash and cash equivalents of $210.2 million, a sharp increase from the $28.5 million recorded on September 30, 2024. This growth is due to several financing operations, including a public offering in October 2024 and private placements in November 2024 and May 2025, which generated net cash inflows of $209.3 million.

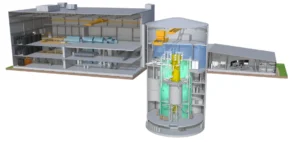

Operating expenses reached $14.7 million during the period, primarily linked to the advancement of the KRONOS MMR project, a high-temperature modular reactor. On the investment side, the company deployed $12.9 million, including $9.1 million for the acquisition of assets related to KRONOS MMR, and $3.8 million for the buildout of a demonstration site in Westchester, New York.

Regulatory Advances and Increased Market Visibility

The KRONOS MMR microreactor, acquired in January 2025, represents the core of NANO Nuclear’s industrial strategy. The company initiated regulatory procedures with the U.S. Nuclear Regulatory Commission (NRC) for the construction of a first prototype at the University of Illinois at Urbana-Champaign. Simultaneously, it is resuming licensing procedures in Canada, where the reactor had previously completed a Phase 1 assessment with the Canadian Nuclear Safety Commission (CNSC).

NANO Nuclear signed a collaboration agreement with AECOM for site-specific engineering, environmental, and regulatory studies at the university location. The NRC also approved a Fuel Qualification Methodology report, a key step in the regulatory process. These milestones position KRONOS MMR as one of the first projects in active pre-construction permit application phase in the United States.

Indexing in Global ETF and Integrated Growth Strategy

On August 7, 2025, NANO Nuclear’s stock was added to the Solactive Global Uranium & Nuclear Components Total Return Index, making it eligible for inclusion in the Global X Uranium ETF, a listed fund with approximately $4 billion in assets under management. This inclusion increases exposure to both institutional and retail investors, enhancing the company’s financial visibility in capital markets.

Additionally, NANO Nuclear is pursuing a vertical integration strategy, marked by the signing of a memorandum of understanding with UrAmerica to secure nuclear fuel supply and structure an integrated value chain. The company is also deploying its proprietary Annular Linear Induction Pump (ALIP) technology at its New York demonstration facility. Developed under the SBIR Phase III program, the system is designed for reactors using advanced heat transfer fluids such as molten salts or liquid metals.

Organizational Structuring and Commercial Outlook

As part of its expansion, NANO Nuclear has hired more than a dozen engineers to support KRONOS MMR activities, mainly in the U.S. Midwest. The company also acquired a 2.75-acre property with buildings in Oak Brook, Illinois, for engineering, R&D, and manufacturing operations. Several strategic appointments were made, including Rick Perry, former U.S. Secretary of Energy, as chairman of the executive advisory board, and Seth Berl, a government technology specialist at Intel Corporation, who joined the board of directors.

Looking ahead, NANO Nuclear anticipates commercial progress in the coming months, particularly with operators of artificial intelligence-powered data centers. The company is also considering applications in remote areas across North America and internationally, while maintaining its objective of submitting a construction permit application to the NRC by early 2026.