The Trump administration signed an executive order on Wednesday imposing 50% tariffs on Brazilian imports, citing national security threats related to the judicial treatment of former president Jair Bolsonaro. The measure comes despite a US trade surplus of $7.4bn with Brazil in 2024, contradicting the administration’s usual economic justifications. The tariffs will take effect in seven days but strategically exclude several categories of products essential to the US economy.

Complex architecture of sectoral exemptions

The exemptions reveal US industrial priorities and supply constraints. Crude oil, accounting for $44.8bn in Brazilian exports to the US in 2024, is completely exempt from the tariffs. This decision preserves access to the 230,000 barrels per day exported by Brazil to the US West Coast according to S&P Global Commodities at Sea data. Refined petroleum products are also exempt, maintaining energy supply flows.

Iron ore and all forms of iron used as steelmaking inputs are exempted, protecting $5.72bn in trade. Brazil remains the second largest steel exporter and the leading iron exporter to the US. Other exemptions include civil aircraft, preserving Embraer, of which 45% of commercial aircraft production is destined for the US market; wood pulp, protecting Suzano; metallurgical alumina; precious metals; and fertilisers.

Political justification without economic precedent

The presidential decree invokes the International Emergency Economic Powers Act (IEEPA) to justify the tariffs. This use of emergency economic powers for the internal political considerations of a third country sets a contentious legal precedent. The administration asserts that Bolsonaro’s prosecution amounts to political persecution threatening US interests. This argument is already being challenged in federal courts regarding presidential authority over tariffs.

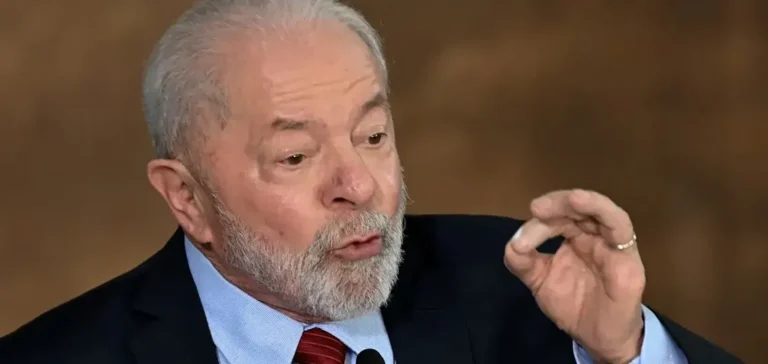

Brazilian president Luiz Inácio Lula da Silva responded by promising reciprocity, highlighting the US trade surplus with Brazil. Data from Brazil’s Ministry of Foreign Trade confirm the US enjoys a positive trade balance, invalidating the traditional argument of trade deficits. Brazilian authorities are preparing retaliation measures, potentially targeting US agricultural exports.

Differentiated impact on Brazilian companies

Sector analysis reveals asymmetric impacts across companies. Embraer saw its shares jump 11% in São Paulo following news of the exemptions. Suzano gained 1% despite initial concerns about pulp exports. Orange juice producers, also exempted, maintain access to the US market where Brazil accounts for more than 70% of imports. These exemptions represent approximately 40 to 50% of the total value of Brazilian exports to the US.

Non-exempted sectors include processed agricultural products, some chemicals, and manufactured goods. Former Brazilian Secretary of Trade Welber Barral estimates that out of about 3,000 categories of exported products, only a fraction benefits from exemptions. Small and medium-sized enterprises without effective lobbying in Washington face the full impact of the tariffs.

Strategic repositioning and trade alternatives

Brazil is accelerating trade negotiations with the European Union and China in response to US tariffs. Data show that China already absorbs 46% of Brazilian crude oil exports and 71% of iron ore exports. This dependence could intensify as Brasília seeks to offset losses in the US market. Brazilian companies are exploring joint ventures in Argentina and Mexico to maintain North American market access via USMCA.

The Brazilian financial sector anticipates increased volatility in the real and adjustments in supply chains. Economic forecasts suggest a limited impact on Brazil’s GDP thanks to the exemptions, estimated between 0.3 and 0.4 percentage points according to Goldman Sachs. The Brazilian strategy combines legal challenges at the WTO, trade diversification, and calibrated retaliation measures aimed at maximising political impact in the US while minimising harm to its own economy.