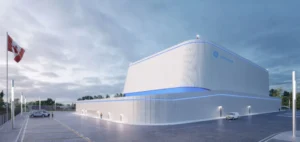

EDF announced the establishment of a project to recycle low-level radioactive metals at the site of the former Fessenheim nuclear plant, in Haut-Rhin, France. The goal of this new technocenter is to recycle so-called “very low-level radioactive” metals, generated from the plant’s decommissioning, into conventional steel and iron ingots.

The project, estimated at around 450 million euros, still requires several regulatory approvals and a public debate. EDF plans for this consultation process to take place from October 10, 2024, to February 7, 2025, during which stakeholders can express their opinions and recommendations to adjust the project if necessary.

A project for economic revitalization

The plant is expected to create 200 direct jobs in this region, which was severely affected by the plant’s closure in 2020, leading to the loss of 2,000 direct and indirect jobs. This project aims to revitalize the area, in partnership with local authorities and regional industrial players. Laurent Jarry, Director of the EDF site in Fessenheim, emphasized that the plant would be built on a 15-hectare plot, reusing some of the annex buildings of the decommissioned plant.

The recycling process would melt these metals to produce ingots weighing around twenty kilograms each, which would then be marketed in the conventional metals market. “We plan to establish partnerships with regional foundries to add value to these ingots,” said Mr. Jarry.

Challenges and regulations to overcome

However, the project requires obtaining environmental clearance and a derogation from the public health code. This latter is crucial for the recycled metals to be reused in full compliance. According to Jean-Louis Laure, president of the public debate commission, there is some local skepticism about the initiative, notably due to lingering resentment following the plant’s closure.

The metals to be processed by this future plant would mainly consist of rubble, soil, and scrap metal generated from the dismantling of nuclear sites or conventional industries using naturally radioactive materials. EDF hopes to avoid the long-term storage of these materials and provide a sustainable valorization solution.

An initiative in response to previous failures

The closure of the Fessenheim plant had also led to a downward revision of a business park project, initially designed to compensate for the job losses, which eventually turned into a fiasco. The public-private partnership created to support this reconversion plan failed to deliver, due to a lack of sufficient political and economic backing. Today, EDF aims to avoid these mistakes with a more structured and better-coordinated approach.

The public debate will help assess the industrial, economic, and health impacts of this technocenter on the region. Although the project is still at a preliminary stage, the issues related to the management of low-level radioactive waste in France, along with the need for local economic revitalization, make this initiative strategic for the group.