The nuclear sector faces major financial challenges. While its role in decarbonization (reducing CO2 emissions) is widely recognized, particularly in terms of meeting climate objectives, the question of financing remains a major obstacle.

Nuclear projects are often perceived as risky, due to their high initial cost, frequent budget overruns and long lead times.

These factors dampen the enthusiasm of private investors, who are essential to accelerating the development of the sector. Governments and companies are therefore looking to hybrid financing models, combining public and private capital, to offset these risks.

The aim is to structure financial mechanisms adapted to the nature of these projects, such as contracts for difference or green bonds.

These tools aim to guarantee stable revenues, in exchange for the long-term supply of energy.

Innovative financing mechanisms for nuclear power

Public financing remains essential for many nuclear projects, particularly in countries like Sweden and Slovenia, where governments are working on risk mitigation solutions.

The use of low-interest public loans or state guarantees to cover potential cost overruns are regularly discussed.

In Sweden, a new financing framework, including electricity price hedging agreements and public loans, is being studied to boost investment in nuclear power.

These strategies aim to offer investors long-term visibility.

Nuclear power plant projects often require several decades of profitability to offset initial investments.

This differs radically from renewable energies, which, while quicker to deploy, do not guarantee the same price stability over several decades.

This is where nuclear power comes into its own, with an infrastructure lifespan of up to 60 years.

Financial players and their crucial role

The financial sector plays a key role in the development of nuclear projects.

Financial institutions such as BNP Paribas, Citi and Brookfield are exploring new ways of financing these projects.

Although private sector involvement is still limited compared with renewable energies, discussions are underway to mobilize more private capital.

The use of green bonds, generally used to finance renewable energy projects, could be extended to nuclear power plants.

This type of financial product makes it possible to raise funds at lower cost in exchange for guarantees of long-term profitability.

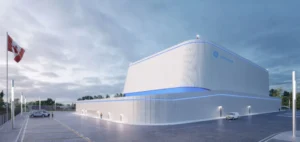

This approach has already been adopted for a number of small modular power plant projects, which, thanks to their reduced size, offer a more flexible and less costly alternative to traditional reactors.

Towards hybrid models to attract investors

One of the most promising solutions for securing financing lies in hybrid models combining public intervention and private capital.

Export credit agencies, which are often called upon for major industrial projects, could play a key role in supporting companies involved in the construction of new power plants.

These hybrid mechanisms enable risks to be spread across several stakeholders, thus facilitating the entry of private investors.

Players such as Guggenheim Securities and Société Générale are also working on solutions to guarantee the financial viability of nuclear projects, notably through long-term electricity supply contracts.

These contracts guarantee fixed prices for the electricity produced, providing investors with financial security over several decades.

This approach compensates for the slower deployment of nuclear infrastructure compared with renewable energies, while ensuring stable and sustainable returns on investment.

The future of nuclear power in the energy transition

The nuclear sector’s growth prospects are directly linked to the ability of governments and financial institutions to innovate in terms of financing.

The use of hybrid models, combining public and private capital, now appears to be the most viable solution for boosting investment in this sector, which is essential to the global energy transition.

New nuclear power plant projects, whether large-scale or based on more flexible modular technologies, depend on the ability of players to put in place stable and secure financial frameworks.

While the financial challenges remain numerous, the initiatives taken by countries such as Sweden and Slovenia show the way to overcoming the obstacles and enabling nuclear power to play a leading role in tomorrow’s energy mix.