Enel S.p.A. (Enel), through its subsidiary Endesa, recently signed an important agreement with Masdar, a major player in renewable energies.

The agreement concerns the sale of 49.99% of EGPE Solar’s capital for a sum of 817 million euros.

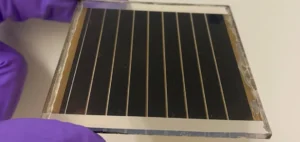

EGPE Solar brings together all Endesa’s photovoltaic assets currently in operation in Spain, representing installed capacity of around 2 GW.

This transaction, which values EGPE Solar at around 1.7 billion euros on a 100% basis, enables Enel to maintain control of the entity while optimizing the profitability of its assets thanks to this strategic partnership.

The long-term partnership model defined in Enel’s 2024-2026 Strategic Plan is at the heart of this strategy.

Partnership structure and financial implications

The agreement includes 15-year power purchase agreements (PPAs), under which Endesa undertakes to purchase all the energy produced by the photovoltaic installations concerned.

In addition, there is provision for possible future hybridization with battery energy storage systems (BESS), adding up to 0.5 GW of additional capacity.

In financial terms, the transaction is expected to reduce the Enel Group’s consolidated net debt by €817 million in 2024.

However, it will have no impact on the Group’s economic results, as Enel will continue to fully control and consolidate EGPE Solar.

Terms of agreement and future prospects

Completion of the sale, expected in the fourth quarter of 2024, is subject to customary preconditions for this type of transaction, including the Spanish government’s approval of foreign investments.

This partnership is in line with Enel’s strategic management model aimed at maximizing productivity and returns on investment while retaining control of core assets.

In addition, EGPE and Masdar have signed a non-binding memorandum of understanding to explore a possible alliance to jointly develop renewable generation projects in Spain.

This collaboration could open up new opportunities for both companies in the renewable energies sector.

Strategic and industrial challenges

This partnership between Enel and Masdar illustrates Enel’s ability to attract substantial investment in its renewable assets.

Enel is thus pursuing its partnership strategy to strengthen its energy portfolio while maintaining a dominant market position.

Masdar, for its part, is consolidating its presence in Europe and strengthening its portfolio of renewable assets.

The agreement also includes potential initiatives for the integration of energy storage technologies, a fast-growing sector that meets the energy market’s increasing need for flexibility and sustainability.

These initiatives could include the installation of battery energy storage systems to improve the efficiency and resilience of the energy grid.

The collaboration between Enel and Masdar reflects a growing trend towards strategic partnerships in the renewable energy sector, where companies are looking to maximize synergies and diversify their revenue streams.

This partnership management model enables Enel to continue innovating and investing in cutting-edge technologies, while sharing risks and benefits with its strategic partners.

The sale of this minority stake represents a key step for Enel, which is strengthening its partnership strategy while optimizing the profitability of its assets.

This partnership with Masdar also paves the way for new collaborations and innovations in the renewable energies sector, responding to current and future energy challenges.