The United States Department of Energy announced on May 30 the termination of 24 projects under the Office of Clean Energy Demonstrations, totalling $3.7bn in federal subsidies initially allocated to emission reduction technologies, including carbon capture and clean hydrogen.

Projects deemed unprofitable

Energy Secretary Chris Wright stated that the projects were considered “uneconomic” following an individual financial review. According to Wright, these initiatives “failed to meet the energy needs of the American people.” The Trump administration had ordered federal agencies in January to halt the distribution of climate-related funds pending a full review of investment portfolios.

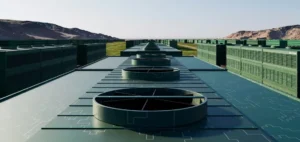

Among the cancelled projects were those from Calpine, which was set to receive $540mn to retrofit its Sutter and Baytown natural gas-fired power plants with carbon capture equipment. ExxonMobil was also affected by the decision, with $332mn earmarked to install hydrogen-capable burners at its Baytown olefins facility. Both companies did not respond to requests for comment.

Impact on heavy industry

The targeted projects also included initiatives in the cement, chemical, steel and mining sectors. A joint venture between Newmont Corporation and Barrick Gold Corporation was among the intended recipients. Some of the funds were also planned for hybrid projects combining renewable energy and energy storage systems.

The cancellation of these funds comes amid a political shift towards prioritising national energy security and return on investment. “The Trump administration is acting to ensure taxpayer dollars are used to strengthen national security and support affordable, reliable energy projects,” Wright said.

Diverging reactions from industry stakeholders

Several private sector representatives voiced concern. Jessie Stolark, Executive Director of the Carbon Capture Coalition, described the funding cuts as “a major step backward.” She noted that the projects had already undergone a rigorous technical review process and that many companies had invested their own capital.

Frank Maisano, counsel at law firm Bracewell, highlighted that many of the projects were based in conservative states with strong support for the president’s energy agenda. “This is clearly a missed opportunity for carbon capture and sequestration projects that have long enjoyed bipartisan support in Congress,” he said.

The Department of Energy has not confirmed whether further cancellations are planned, particularly for hydrogen projects valued at approximately $4bn, which are not currently listed among the terminated awards.