VMOS S.A., a joint venture involving Argentina’s state-run oil company Yacimientos Petrolíferos Fiscales (YPF), Vista Energy Argentina, Pampa Energía, and Pan American Sur, announced on Tuesday the signing of a USD 2 billion financing agreement to fund the construction of the Vaca Muerta South pipeline. This pipeline, crucial for Argentina’s energy sector, will increase the transportation capacity of natural gas from the Vaca Muerta formation, globally recognized for its significant unconventional hydrocarbon reserves.

Financing Features

The loan, with a five-year term, was granted to VMOS S.A. with an interest rate indexed to the Secured Overnight Financing Rate (SOFR), plus 5.5%. This financing structure is particularly representative of the current conditions of the international financial market for major infrastructure energy projects in Latin America. VMOS will use these funds to accelerate the realization of this strategic project, essential for the rapid expansion of Argentina’s unconventional natural gas production. The funds secured represent a decisive step toward the large-scale commercial exploitation of the Vaca Muerta basin.

Strategic Importance of the Project

The Vaca Muerta South pipeline is intended to directly connect the fields operated by YPF and its partners to an expanded national network, thus significantly increasing the volume of gas available on the Argentine market. Currently, Argentina heavily depends on liquefied natural gas (LNG) imports, a situation that places a substantial strain on its trade balance and foreign currency reserves. The commissioning of this infrastructure should have a noticeable impact on reducing national energy costs while supporting Argentina’s energy autonomy.

The companies involved specified that the pipeline’s commissioning is expected within two to three years from the start of construction. This ambitious timeline reflects Argentina’s urgency to optimize its natural resources in a context marked by economic pressures and growing energy needs. Once at full capacity, the infrastructure could double the current natural gas production from the Vaca Muerta basin.

National Energy Context

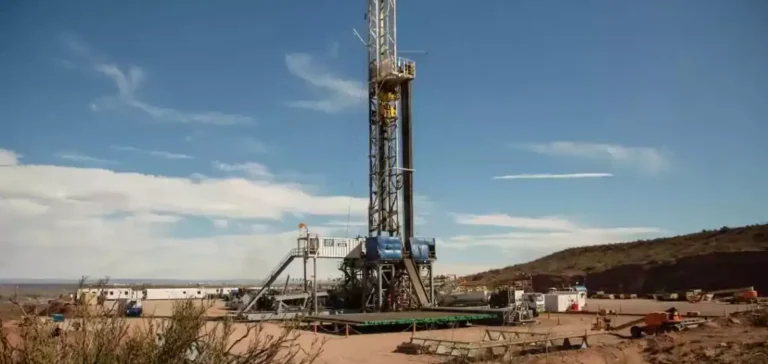

The Vaca Muerta formation represents one of the world’s largest shale gas and oil deposits, comparable to those exploited in the United States. Its development is at the heart of the Argentine government’s economic strategy, which places strong reliance on these resources to ensure growth. However, up to now, the exploitation of Vaca Muerta’s energy potential has been limited by a lack of transport and processing capacity for the extracted hydrocarbons.

The financing obtained by VMOS S.A. thus represents a crucial step to overcome these logistical constraints. The investment will not only support the growth of the local gas industry but also attract further international financing to similar projects, thereby strengthening investor confidence in the Argentine market.