Venezuela’s political and economic landscape continues to evolve, marked by growing tensions between Nicolás Maduro’s government and the United States.

Recently, the US Treasury Department imposed sanctions on 16 officials aligned with Maduro, including members of the National Electoral Council and the Supreme Court of Justice.

The sanctions follow July’s disputed election, which was widely criticized for its lack of transparency and fairness.

The sanctions aim to weaken Maduro’s institutional support, targeting those who have helped maintain his power.

The sanctions include key figures such as the judge and prosecutor who authorized the arrest warrant for opposition presidential candidate Edmundo González Urrutia.

The latter has since fled the country and sought protection in Spain.

In parallel, the US State Department has also introduced new visa restrictions for officials aligned with Maduro.

A State Department official said these measures should prompt officials to reflect on the consequences of supporting a regime that seeks to maintain power through questionable means.

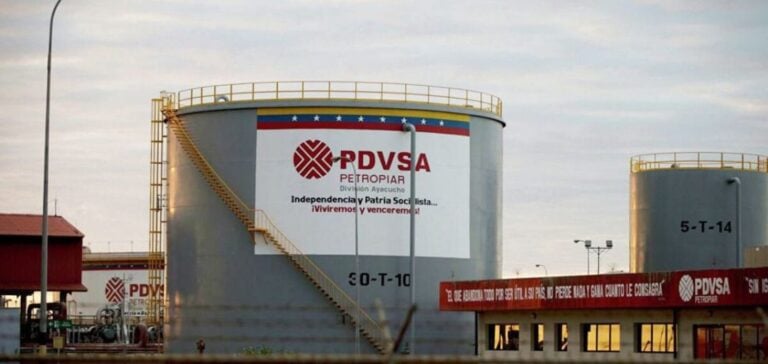

Impact on the energy sector

Experts believe that these sanctions will have no immediate impact on the Venezuelan oil sector.

Rachel Ziemba, Senior Consultant at Horizon Engage, points out that the individuals sanctioned are not directly linked to the energy industry.

Moreover, there is no indication that the US is considering modifying the company-specific licenses that have recently been granted.

It notes that, while sanctions complicate the situation in the long term, global supply and demand fundamentals remain key drivers for oil markets.

However, political developments could influence the oil sector.

Fernando Ferreira, Director of Geopolitical Risk at Rapidan Energy Group, mentions that diplomatic tensions, such as those between Venezuela and Spain, could damage investor confidence.

Jorge Rodríguez, President of the Venezuelan Parliament, recently called for diplomatic relations with Spain to be broken off, which could have repercussions on investment efforts in the country.

Political and legislative reactions

U.S. legislators, such as Senator Dick Durbin, are also working on legislative proposals concerning Venezuela.

Durbin has introduced a bill to halt all U.S.-Venezuela oil cooperation until election results are respected.

In a statement, he asserted that “the Maduro regime is clinging to power thanks to oil revenues dependent on U.S. involvement”.

This bill could have significant implications for the Venezuelan economy, which relies heavily on oil exports.

Recent sanctions have also affected several members of the Supreme Court of Justice, which certified Maduro’s election victory.

Among those sanctioned are judges and prosecutors who played a role in the crackdown on political opponents.

Maduro’s government has rejected the sanctions, calling them illegitimate and aggressive.

Yván Gil, Chancellor of the Republic, said the measures were an attack on Venezuela’s sovereignty.

Future prospects

In the short term, the sanctions are unlikely to disrupt oil production, which rose slightly to 914,000 barrels per day in August.

However, the medium-term outlook remains uncertain.

Experts agree that the unstable political situation and international tensions could slow down the investments needed to revive the oil sector.

Venezuela’s dependence on oil revenues, combined with increasing sanctions, creates a difficult environment for any economic recovery.

Sanctions and political tensions underline the complexity of the situation in Venezuela.

As Maduro’s government continues to face internal and external challenges, the international community is keeping a close eye on developments.

Decisions taken by the US and others could have lasting repercussions on the country’s political and economic stability, as well as on the global oil market.