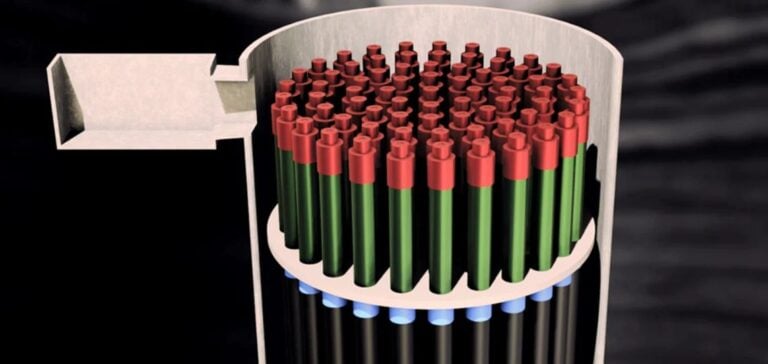

Vallourec, a specialist in seamless premium tubular solutions, has received official qualification from certification body DNV for Delphy, its vertical gaseous hydrogen storage solution. This qualification, achieved after a rigorous development and testing process, marks a major milestone for the company and the hydrogen industry. Delphy enables storage of between 1 and 100 tonnes of hydrogen under maximum safety conditions while requiring minimal ground space. The system, which can reach depths of up to 100 metres, addresses the specific needs of complex industrial environments.

The Delphy vertical storage system targets not only green hydrogen producers but also various industrial sectors such as synthetic fuel producers (e-SAF, e-methanol), green ammonia facilities, steelworks and refineries. The solution incorporates proven technologies in terms of corrosion resistance and sealing, based on Vallourec’s long-standing expertise in tubes and connections.

Launched in 2022, the project involved around 30 researchers and experts working in areas such as high-precision threading, thermal treatments and non-destructive testing. Since the inauguration of the demonstrator in December 2023, Vallourec has conducted a series of evaluations and validations to ensure the reliability and safety of Delphy. The qualification granted by DNV serves as assurance of compliance with the industry’s most stringent standards.

Vallourec has already signed memoranda of understanding with H2V for green hydrogen projects and with NextChem Tech for initiatives involving green hydrogen and ammonia. In parallel, the company is engaged in discussions for around 50 projects in France and internationally, representing a potential turnover of €2bn ($2.17bn). This development comes amid growing demand for hydrogen storage infrastructure, driven by European regulations and decarbonisation policies.

Hydrogen market outlook

The hydrogen market, especially for green hydrogen, is experiencing strong growth with increasing need for storage solutions suited to intermittent production. European regulation, which mandates strong alignment with renewable electricity production, is reinforcing demand for systems such as Delphy. The French hydrogen strategy, promoting operational flexibility among green hydrogen producers, also supports adoption of this technology.

Philippe Guillemot, Chairman and Chief Executive Officer of Vallourec, stated that Delphy’s qualification reflects the company’s ability to apply its industrial and technological know-how to new energy fields. He added: “This important milestone strengthens our position in the hydrogen market and our leadership in supporting decarbonisation projects on a global scale.”

DNV’s role in certification

Santiago Blanco, Executive Vice President and Regional Director Southern Europe, Energy Systems at DNV, commented: “DNV is proud to qualify Vallourec’s Delphy hydrogen storage solution. It is an important step towards safe and scalable infrastructure.” He noted that global hydrogen demand could reach 188mn tonnes per year by 2050, a context in which flexible and reliable storage solutions like Delphy are essential to meet rising industrial needs.