French seamless tube manufacturer Vallourec has announced the completion of the acquisition of Thermotite do Brasil, a former subsidiary of Canadian group Mattr. The agreement, signed in September 2024, received all necessary regulatory approvals, allowing Vallourec to finalise the operation within the originally planned timeframe.

Strengthening the value chain in Brazil

Thermotite do Brasil specialises in thermal insulation coatings for subsea pipelines. This type of technology is essential to maintain the flow of hydrocarbons in offshore environments, where extreme temperatures can lead to production blockages. By integrating this expertise into its portfolio, Vallourec increases its ability to deliver a complete offer in deepwater oil and gas projects.

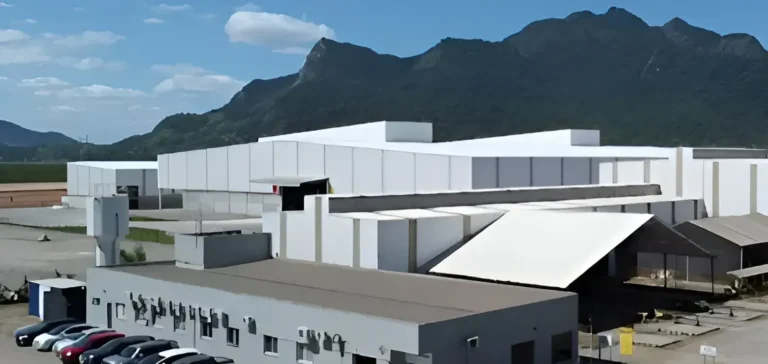

According to Vallourec, this move aligns with its strategy to upgrade its industrial offering in high-technical-value markets. The company already has a strong presence in Brazil, with multiple production sites. The acquisition of Thermotite is expected to give Vallourec control over an additional segment of the production chain in offshore infrastructure services.

Technological capabilities and strategic positioning

By combining its premium tubular solutions with Thermotite’s thermal coating technologies, Vallourec aims to deliver integrated services tailored to the demands of major offshore projects. This kind of technological pairing is particularly relevant to oil companies active in Brazil, one of the world’s leading offshore deepwater exploration markets.

Philippe Guillemot, Chairman of the Board and Chief Executive Officer of Vallourec, stated that this acquisition marked “a new step in our strategy to offer our clients integrated solutions with very high added value.” No official amount has been disclosed for the acquisition.

Transaction conditions and outlook

The transaction closes at a time when the Brazilian energy market is attracting significant investments in subsea equipment. With this acquisition, Vallourec gains an additional asset to compete in tenders launched by major oil companies operating in the Santos Basin and other offshore zones in the South Atlantic.

Mattr, formerly known as Shawcor, is continuing with its strategy of refocusing on other industrial divisions. The deal with Vallourec is part of a broader reorganisation of its international asset portfolio.