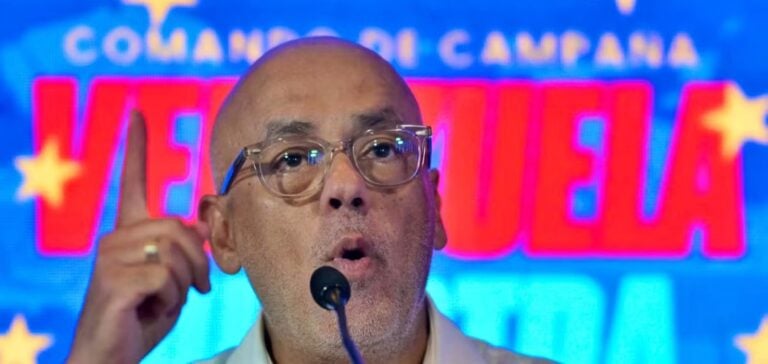

Venezuela and the United States recently resumed bilateral talks in a tense context marked by US sanctions on the Venezuelan oil sector. Jorge Rodriguez, Venezuela’s chief negotiator and president of the National Assembly, announced on the X platform that the two countries were determined to “gain trust and improve relations” through respectful and constructive communication.

Venezuelan President Nicolas Maduro surprised many by announcing the resumption of talks less than a month before the July 28 presidential election. This move is part of a series of discreet negotiations begun last year in Qatar.

During these preliminary discussions, a significant agreement was reached on the exchange of prisoners: the United States released Alex Saab, close to Maduro, in exchange for 28 prisoners, including 10 Americans and 18 Venezuelans. In return, the United States had temporarily eased the oil embargo imposed since 2019.

However, relations deteriorated again last April when Washington reimposed sanctions following the ineligibility of opposition figure Maria Corina Machado for the presidential election. This decision was seen by Caracas as an attempt to control and manipulate the Venezuelan oil industry.

Despite these obstacles, Nicolas Maduro remains optimistic, advocating “dialogue, understanding and a future for our relations” based on sovereignty and absolute independence. This statement underlines Venezuela’s determination to pursue a path of dialogue, despite ongoing tensions with the United States.

The road to full normalization of relations seems fraught with difficulties, but the resumption of talks shows an openness to collaboration. The coming months will be crucial for observing the evolution of this dynamic and its potential impact on the global energy sector.

United States and Venezuela resume dialogue despite sanctions

Venezuela and the United States have agreed to strengthen bilateral relations after virtual talks, despite persistent US sanctions on the oil sector.

Share:

Comprehensive energy news coverage, updated nonstop

Annual subscription

8.25$/month*

*billed annually at 99$/year for the first year then 149,00$/year

Unlimited access • Archives included • Professional invoice

OTHER ACCESS OPTIONS

Monthly subscription

Unlimited access • Archives included

5.2$/month*

then 14.90$ per month thereafter

FREE ACCOUNT

3 articles offered per month

FREE

*Prices are excluding VAT, which may vary depending on your location or professional status

Since 2021: 35,000 articles • 150+ analyses per week

- Popular on energynews.pro

After two seizures in ten days, U.S. authorities are pursuing another tanker suspected of evading sanctions. Maritime tracking data and official statements point to intensified controls on crude cargoes linked to Venezuela.

China reduces its mining presence in Canada and Greenland, constrained by hostile regulatory frameworks, and consolidates public investments in Arctic Russia to secure strategic supplies.

The Turkish president suggested to Vladimir Putin a limited ceasefire targeting Ukrainian ports and energy facilities to reduce risks to strategic assets and pave the way for negotiations.

New Delhi and Moscow strengthen their energy corridor despite US tariff and regulatory pressure, maintaining oil flows supported by alternative logistical and financial mechanisms.

The United States strengthens its energy presence in the Eastern Mediterranean by consolidating a gas corridor through Greece to Central Europe, to the detriment of Russian flows and Chinese logistical influence over the Port of Piraeus.

Paris and Beijing agree to create a bilateral climate task force focused on nuclear technologies, renewable energy and maritime sectors, amid escalating trade tensions between China and the European Union.

Ankara plans to invest in US gas production to secure LNG supply and become a key supplier to Southern Europe, according to the Turkish Energy Minister.

Three Russian tankers targeted off the Turkish coast have reignited Ankara’s concerns about oil and gas supply security in the Black Sea and the vulnerability of its subsea infrastructure.

Bucharest authorises an exceptional takeover of Lukoil’s local assets to avoid a supply shock while complying with international sanctions. Three buyers are already in advanced talks.

European governments want to add review and safeguard mechanisms to the trade deal with Washington to prevent a potential surge of US imports from disrupting their industrial base.

The Khor Mor gas field, operated by Pearl Petroleum, was hit by an armed drone, halting production and causing power outages affecting 80% of Kurdistan’s electricity capacity.

Global South Utilities is investing $1 billion in new solar, wind and storage projects to strengthen Yemen's energy capacity and expand its regional influence.

British International Investment and FirstRand partner to finance the decarbonisation of African companies through a facility focused on supporting high-emission sectors.

Budapest moves to secure Serbian oil supply, threatened by Croatia’s suspension of crude flows following US sanctions on the Russian-controlled NIS refinery.

Moscow says it wants to increase oil and liquefied natural gas exports to Beijing, while consolidating bilateral cooperation amid US sanctions targeting Russian producers.

The European Investment Bank is mobilising €2bn in financing backed by the European Commission for energy projects in Africa, with a strategic objective rooted in the European Union’s energy diplomacy.

Russia faces a structural decline in energy revenues as strengthened sanctions against Rosneft and Lukoil disrupt trade flows and deepen the federal budget deficit.

Washington imposes new sanctions targeting vessels, shipowners and intermediaries in Asia, increasing the regulatory risk of Iranian oil trade and redefining maritime compliance in the region.

OFAC’s licence for Paks II circumvents sanctions on Rosatom in exchange for US technological involvement, reshaping the balance of interests between Moscow, Budapest and Washington.

Finland, Estonia, Hungary and Czechia are multiplying bilateral initiatives in Africa to capture strategic energy and mining projects under the European Global Gateway programme.